Comprehensive corporate income tax audits improve future tax compliance, but narrow scope audits can actually reduce compliance

According to recent estimates, achieving the UN Sustainable Development Goals (SDGs) for low-income countries will require increasing domestic revenues by around 15 percentage points of GDP (Gaspar et al. 2019). Since 1990, many developing countries have seen an increase in domestic revenue mobilisation, but following the COVID-19 pandemic this trend is expected to reverse (UNDP 2020). Among the key policy reforms needed for improving revenue mobilisation is strengthening tax administration capacity, and in particular tax auditing. Given capacity constraints faced by tax authorities, understanding the role of operational tax audits in deterring noncompliance is vital.

Tax audits contribute to enhancing tax compliance through three main channels. First, tax audits have a direct (and specific) effect through verification and any adjustment identified on the audited tax returns. Second, there is a deterrence effect (direct) on the future compliance behaviour of taxpayers who have been audited. Third, there is a deterrence effect (indirect) through those who have not experienced an audit but belong to the wider network of taxpayers who have.

Evaluating tax audits in Rwanda

In a recent working paper working paper (Kotsogiannis, Salvadori, Karangwa and Mukamana 2021), we investigate the role of tax audits in deterring future noncompliance of incorporated businesses in Rwanda. We pay particular attention to evaluating the impact of different types of audits that typically differ in their level of intensity. Focusing on corporate income tax audits is important for two reasons. First, there is scant evidence on this, and secondly it is a very important tax base for tax revenues and therefore revenue mobilisation and sustainable development. Evaluating tax auditing in the Rwandan context also presents a unique opportunity in understanding how well tax audits perform in a developing country that is embracing reforms and whose economy over the last decade has been growing steadily, earning the country a reputation as one of Africa’s fastest-growing economies.

To address the research priorities discussed above we make use of a unique administrative data set provided by the Rwandan Revenue Authority (RRA) which consists of the administrative filings and tax audits performed in Rwanda. More specifically, the analysis utilises the universe of corporate income tax (CIT) and value added tax (VAT) anonymised declarations for the period 2013-2018, the universe of risk-based anonymised audit data for the audit wave in 2015, as well as detailed information on the risk rules and criteria with the corresponding risk weighting scheme employed by RRA to prioritise CIT filers for audit selection. Tax audits are prioritised by RRA through a risk-based assessment (and computerised) procedure which implies that the audited taxpayers might not be in a statistical sense identical to the unaudited ones. To address any potential selection bias, the analysis combines several matching techniques with a difference-in-difference approach. RRA classifies business as Micro, Small, Medium, and Large, depending on (broadly speaking) their turnover.

Who files taxes, and who gets audited?

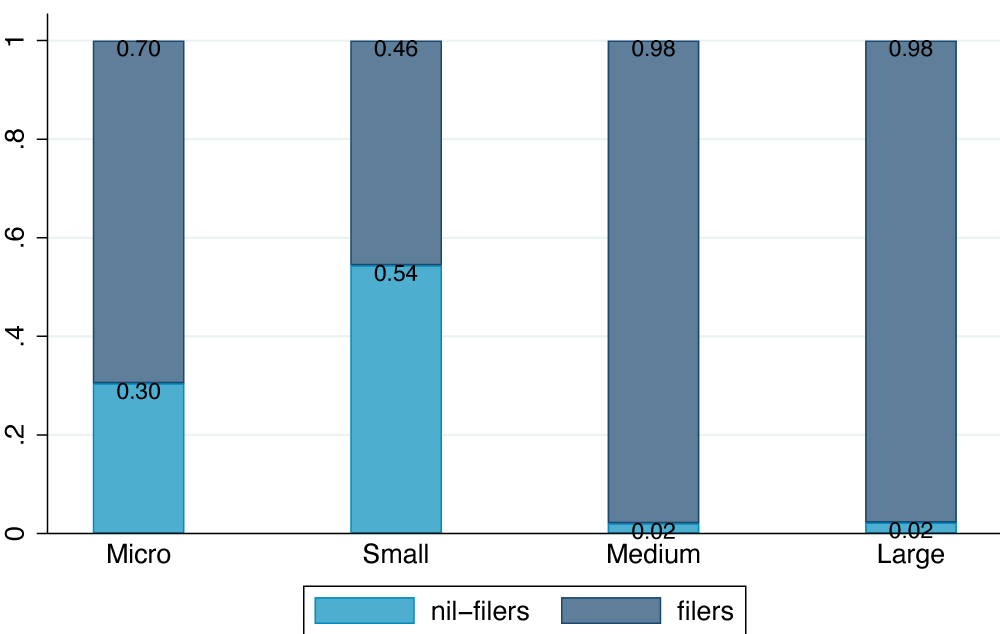

Three characteristics of the Rwandan economy are worth emphasising. First, as shown in Figure 1 there is a significant number of nil-filers, classified as businesses who declare zero across all tax declaration form items.

Figure 1 Nil-filers and filers by business size classification, 2015-2018

Note: Authors’ calculations based on data provided by RRA.

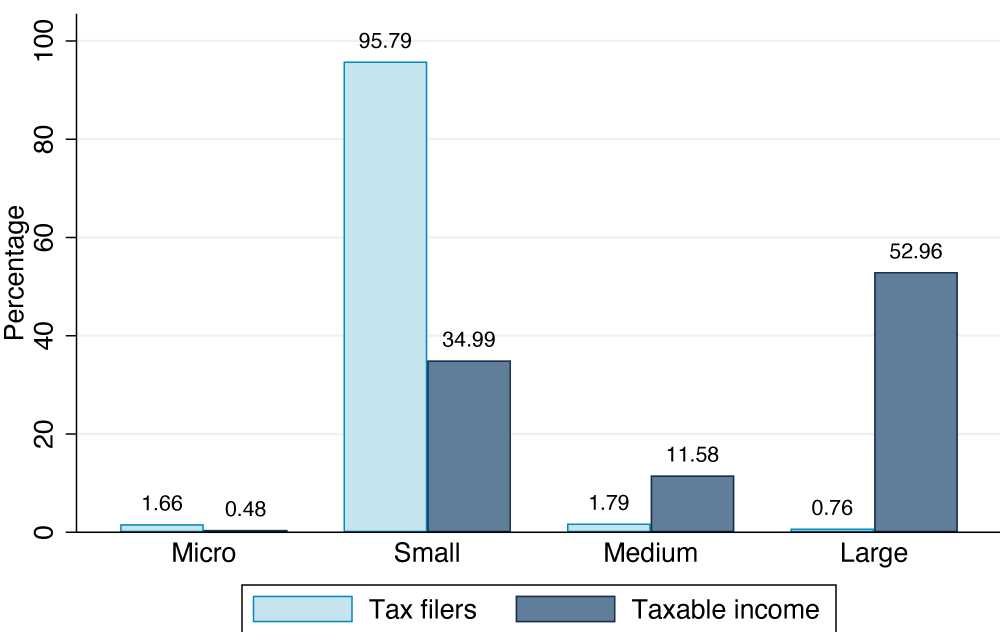

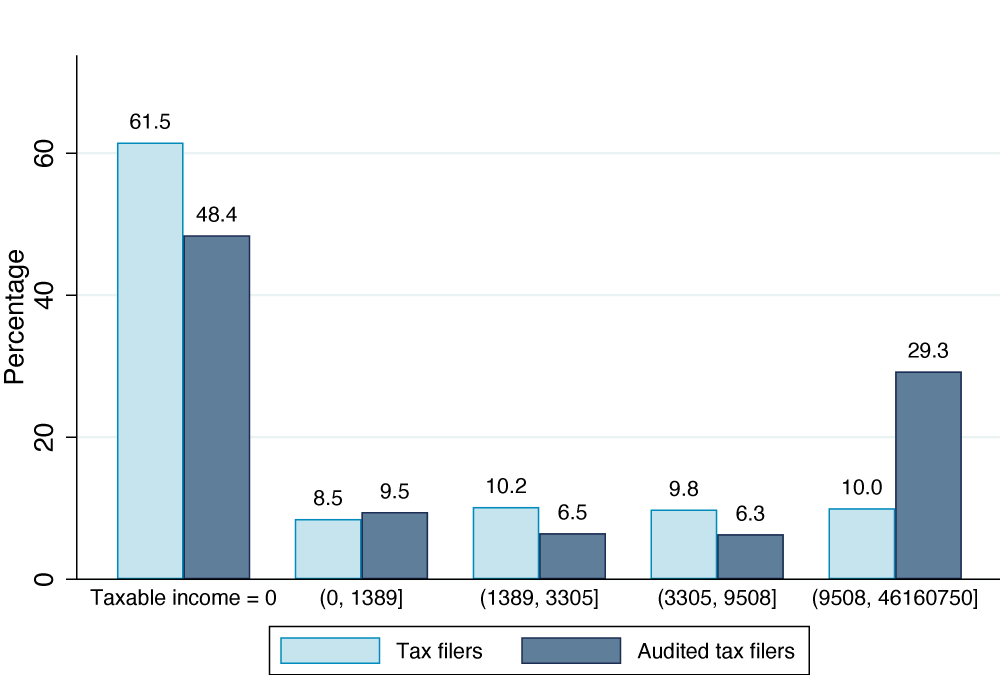

Second, most corporate taxable income is reported by large businesses (Figure 2); over 90% of CIT revenues are collected from less than 10% of large businesses. Third, tax audits follow a U shape (Figure 3) – most audits target businesses declaring zero taxable income (48.3% of total tax audits) and large businesses (in terms of taxable income declared, 29.3% of the total tax audits).

Figure 2 Distribution of businesses and taxable income, 2015-2018

Note: Authors’ calculations based on data provided by RRA.

Figure 3 Distribution of businesses and audits by taxable income deciles, average 2013-2016

Note: Authors’ calculations based on data provided by RRA.

Do tax audits deter future noncompliance?

The results suggest that there is on average a sizable pro-deterrence effect of tax audits on corporate taxable income (CTI) and CIT paid by audited businesses, but this is short-lived. Specifically, the estimates reveal that on average audited businesses report about 20.7% more CTI the first year after they have been audited, relative to similar businesses who have not been audited. This equates to roughly 12.3% more CIT revenues compared to businesses in the control group and corresponds to approximately 2.8% of the total CIT revenues reported by all incorporated businesses that year. The effect estimated is lower in magnitude in subsequent years, but is not statistically significant. Interestingly, the short-lived positive impact of tax audits on compliance seems to be driven by audited businesses who have been found noncompliant during the audit. The results are robust across different estimation approaches.

Does the type of audit matter?

RRA performs two types of audits, ‘narrow scope’ and ‘comprehensive’. Narrow scope are used by RRA for reviewing taxes filed and other documents submitted to the Revenue Authority, and tend to focus on a single item of the tax return. Narrow scope audits are considered impersonal and are significantly less costly to undertake. Comprehensive audits, on the other hand, are in-depth, in-person, and across tax base examinations that involve the inspection of the accounting books as well as transactions of the audited firms. Over the study period, narrow scope audits account for around 60% of all tax audits performed by RRA. This, undoubtedly, is a number that is likely to increase following COVID-19 and the restrictions imposed by the Revenue Authority on face-to-face meetings in an effort to mitigate the spread of the virus.

Given that narrow scope and comprehensive tax audits are of different intensities (and possibly different accuracy levels in identifying corporate income underreporting), intuition might suggest that they could be perceived differently by the taxpayer in their calculus of how much tax liability to underreport (for example, see Allingham and Sandmo (1972)). Consequently, these two different types of audits might have different impact on businesses’ compliance behaviour. Indeed, as explained below, this is the case.

Only comprehensive audits improve tax compliance

Our results show that comprehensive audits drive the pro-deterrence result with an average increase of approximately 28.5% in CTI reported, corresponding to 24.6% more CIT payable reported by audited taxpayers after receiving this specific type of audit. Interestingly, and perhaps surprisingly, narrow scope audits tend to have a non-significant effect the first year after the start of the audit process and have an opposite (counter-deterrent) effect from the second year following the audit. This translates to a reduction of about 23.5% in CTI reported by taxpayers that experienced this kind of audit. In terms of CIT revenues, these audits correspond to a reduction of 9.5%. As noted above a possible explanation for this behaviour (and further conceptualised in our paper) is that businesses who experience low intensity audits and have underreported on fields not examined under a narrow scope audit may update their likelihood of being audited again downwards, since narrow scope audits are ‘noisy’.

Implications for tax policy in the developing world

Interestingly, our results are consistent with the evidence provided by the recent contribution of Erard et al. (2019) for the US suggesting that correspondence tax audits (for self-employed taxpayers) appear to be substantially less consistent in terms of improving future taxpayers’ reporting behaviour and are therefore not a perfect substitute for face-to-face (comprehensive) examinations. This is also in line with recent experimental evidence from Kasper and Alm (2022) who show that tax audits have differential effects on post-audit compliance based on their level of effectiveness, with effective audits increasing future tax compliance and ineffective audits having the opposite effect.

These findings come at a critical moment in the tax policy discourse for the developing world. Revenue mobilisation is ever more challenging in this context, particularly following the COVID-19 pandemic and as tax authorities tend to rely more on desk-based audits. For tax policies, these results suggest that Revenue Authorities ought to be paying closer attention to the evaluation of tax audits (and their types) as well as the processes followed during audits.

References

Allingham, M G and A Sandmo (1972), “Income Tax Evasion: A Theoretical Analysis”, Journal of Public Economics 1(3-4): 323-328.

Advani, A, W Elming and J Shaw (2021), “The Dynamic Effects of Tax Audits”, The Review of Economics and Statistics (in press).

Alm, J and A Malézieux (2021), “40 Years of Tax Evasion Games: A Meta-Analysis”, Experimental Economics 0(0): 1–52.

Balán, P, A Bergeron, G Tourek and J Weigel (2021), “Local Elites as State Capacity: How City Chiefs Use Local Information to Increase Tax Compliance in D.R. Congo”, CEPR Working Paper, 15138.

Beer, S, M Kasper, E Kirchler and B Erard (2020), “Do Audits Deter or Provoke Future Noncompliance? Evidence On Self-Employed Taxpayers”, CESifo Economic Studies 66(3): 248–264.

Besley, T, E Ilzetzki and T Persson (2013), “Weak States and Steady States: The Dynamics of Fiscal Capacity”, American Economic Journal: Macroeconomics 5(4): 205– 235.

Bergeron, A, G Tourek and J Weigel (2020), “The State Capacity Ceiling on Tax Rates: Evidence from Randomized Tax Abatements in the DRC”, Mimeo.

Best, M, J Shah and M Waseem (2021), “The Deterrence Value of Tax Audit: Estimates from a Randomised Audit Program”, Mimeo.

Brockmeyer, A, S Smith, M Hernandez and S Kettle (2019), “Casting a Wider Tax Net: Experimental Evidence from Costa Rica”, American Economic Journal: Economic Policy 11(3): 55–87.

DeBacker, J, B T Heim, A Tran and A Yuskavage (2018a), “Once Bitten, Twice Shy? The Lasting Impact of Enforcement on Tax Compliance”, Journal of Law and Economics 61(1): 1–35.

DeBacker, J, B T Heim, A Tran and A Yuskavage (2018b), “The Effects of IRS Audits on EITC Claimants”, National Tax Journal 71(3): 451–484.

Erard, B, E Kirchler and J Olsen (2019), “Audit impact study: The specific deterrence implications of increased reliance on correspondence audits”, In Taxpayer Advocate Service: Annual Report to Congress 2019, pp. 257–268.

Gaspar, V, D Amaglobeli, M Garcia-Escribano, D Prady and M Soto (2019), “Fiscal policy and development: Human, social, and physical investment for the SDGs”, IMF Staff Discussion Note, SDN/19/03.

IMF (2015), “Current Challenges in Revenue Mobilization - Improving Tax Compliance”, IMF Policy Paper, 5.

Kasper, M and J Alm (2022), “Audits, Audit Effectiveness, and Post-audit Tax Compliance”, Journal of Economic Behaviour and Organization 195: 87-102..

Kleven, H J, M B Knudsen, C T Kreiner, S Pedersen and E Saez (2011), “Unwilling or Unable to Cheat? Evidence From a Tax Audit Experiment in Denmark”, Econometrica 79(3): 651–692.

Kotsogiannis, C, L Salvadori, J Karangwa and T Mukamana (2022), “Do Tax Audits Have a Dynamic Impact? Evidence from Corporate Income Tax Administrative Data”, TARC Discussion Paper 035 - 21.

OECD, AUC and ATAF (2020) Revenue Statistics in Africa 2020. OECD Report.

Rwanda Revenue Authority (2017), Tax statistics in Rwanda, Fiscal Year 2018/2018, Second Edition.

Slemrod, J (2019) “Tax Compliance and Enforcement”, Journal of Economic Literature 57(4): 904–954.

Tourek, G and R Dada (2021), “Peer Information and Social Norms in Tax Compliance: Evidence from Rwanda”, Mimeo.

UN-DESA (2016), The Millennium Development Goals Report 2015.

UNDP (2020), ”COVID-19 and Human Development: Assessing the Crisis, Envisioning the Recovery”, United Nations Development Programme, New York.

Waseem, M (2021), “The role of withholding in the self-enforcement of a value-added tax: Evidence from Pakistan”, Review of Economics and Statistics 0(0): 1–44.