Informality, compliance costs, and weak administrative capacity all constrain the effectiveness of VAT in lower-income countries. However, it is a crucial source of revenue that is better than the alternatives, so governments should focus on reforms that make the VAT more efficient.

The value-added tax (VAT) has now been adopted in 175 countries. The VAT is particularly important for low and middle-income countries, where it raises around 30% of total tax revenue and is often the first tool that governments turn to in times of fiscal crisis. The VAT is as popular with economists as it is with governments since, in its textbook form, it does not favour the use of one type of input over another, nor the production by certain types of firms over others (Diamond and Mirrlees 1971) – as economists would say, it is “production efficient”.

Our research (Brockmeyer et al. 2024) assembles VAT administrative data from 11 countries, ranging from low-income Ethiopia to high-income France. This evidence shows that, in the real-world, VAT often falls far short of its theoretical ideal, especially due to the challenges of informality, compliance costs and weak administration prevalent in lower-income countries.

VAT collections are extremely concentrated among few firms

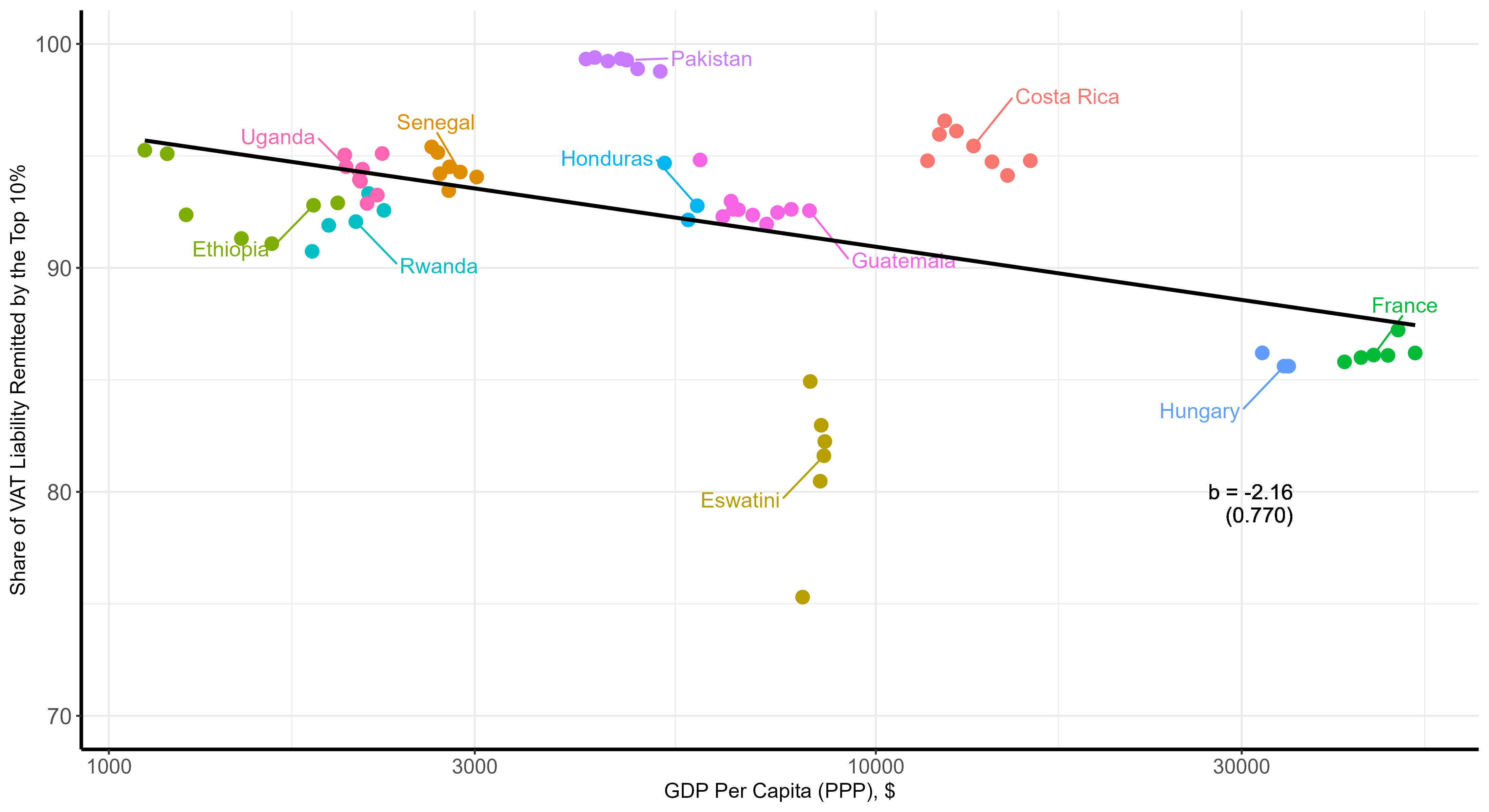

Our first finding is that although the VAT is intended as a broad-based tax on all firms, in practice VAT revenue is highly concentrated amongst a narrow group of firms. In high-income countries such as France and Hungary, around 85% of VAT revenue is generated by the top 10% of firms. In lower-income countries, this figure rises to around 95%. As a result, tax authorities have to spend time dealing with small businesses that account for very little revenue, and many small businesses have to spend hours trying to comply with VAT.

Figure 1: The concentration of VAT revenue is correlated with a country’s development level

Small firms appear to be disadvantaged relative to large firms

In addition, exemptions and reduced rates are widespread. Exemptions have long been recognised as a threat to “production efficiency” (Ebrill et al. 2001). For example, a firm selling exempt goods is not allowed to reclaim VAT paid on its inputs, which creates a strong incentive for the firm to produce as much in-house. Almost every country with a VAT has reduced or exempt products, although the revenue foregone tends to be higher in lower-income countries.

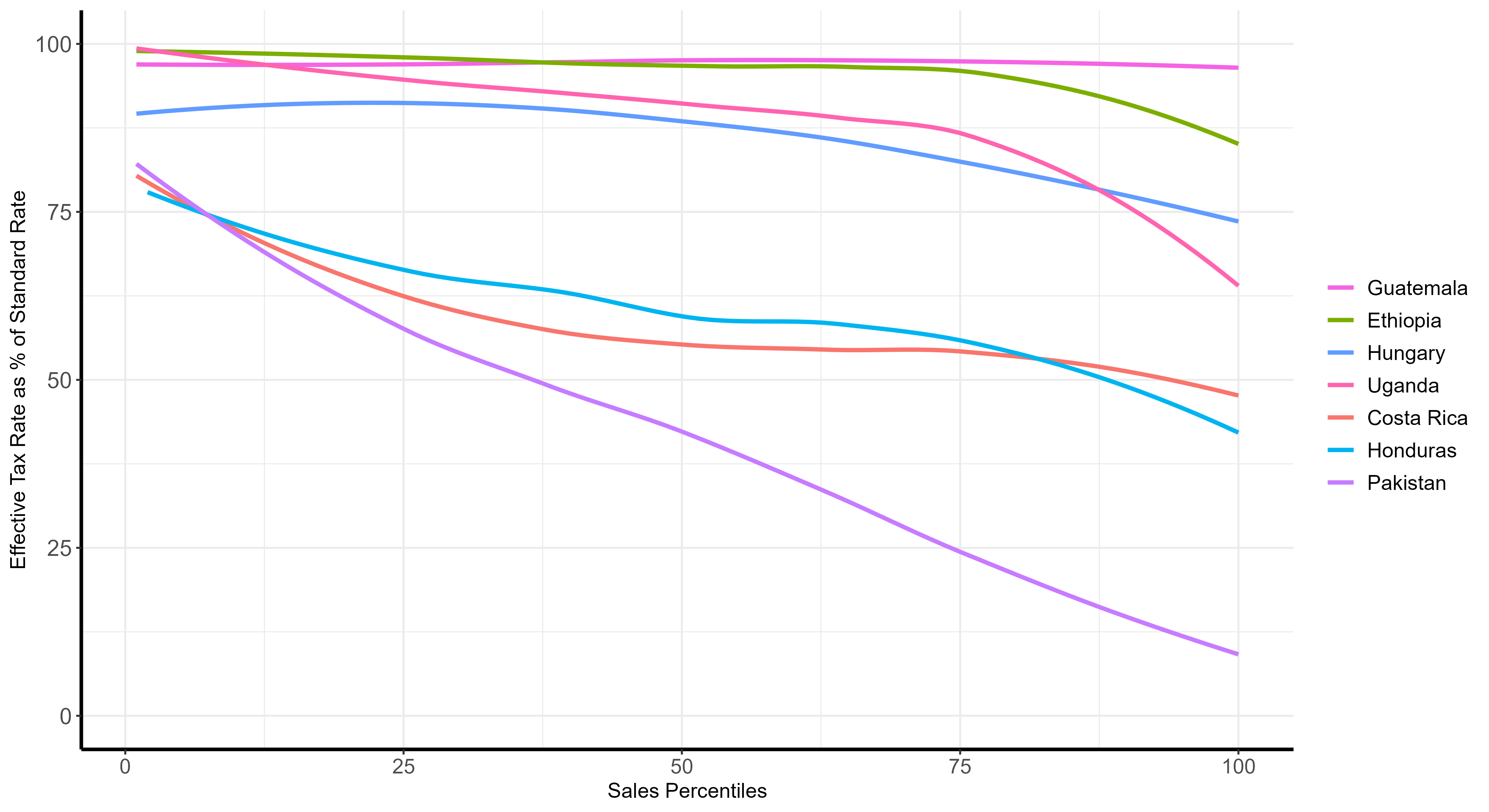

Our dataset also reveals another interesting feature of exemptions / reduced rates: that in most countries, they are more likely to be claimed by larger firms, resulting in lower effective tax rates for the largest firms. As Figure 2 shows, in Honduras, firms in the 10th percentile of firm size face an effective tax rate of 75% of the standard rate, while firms in the 90th percentile face an effective tax rate of 45% of the standard rate. This result holds true even for large and small firms operating in the same industry (this analysis excludes exporters, as exports are zero-rated under the destination-based principle of the VAT).

Figure 2: Effective tax rates (as a percentage of the standard VAT rate) are much lower for large firms than for small firms

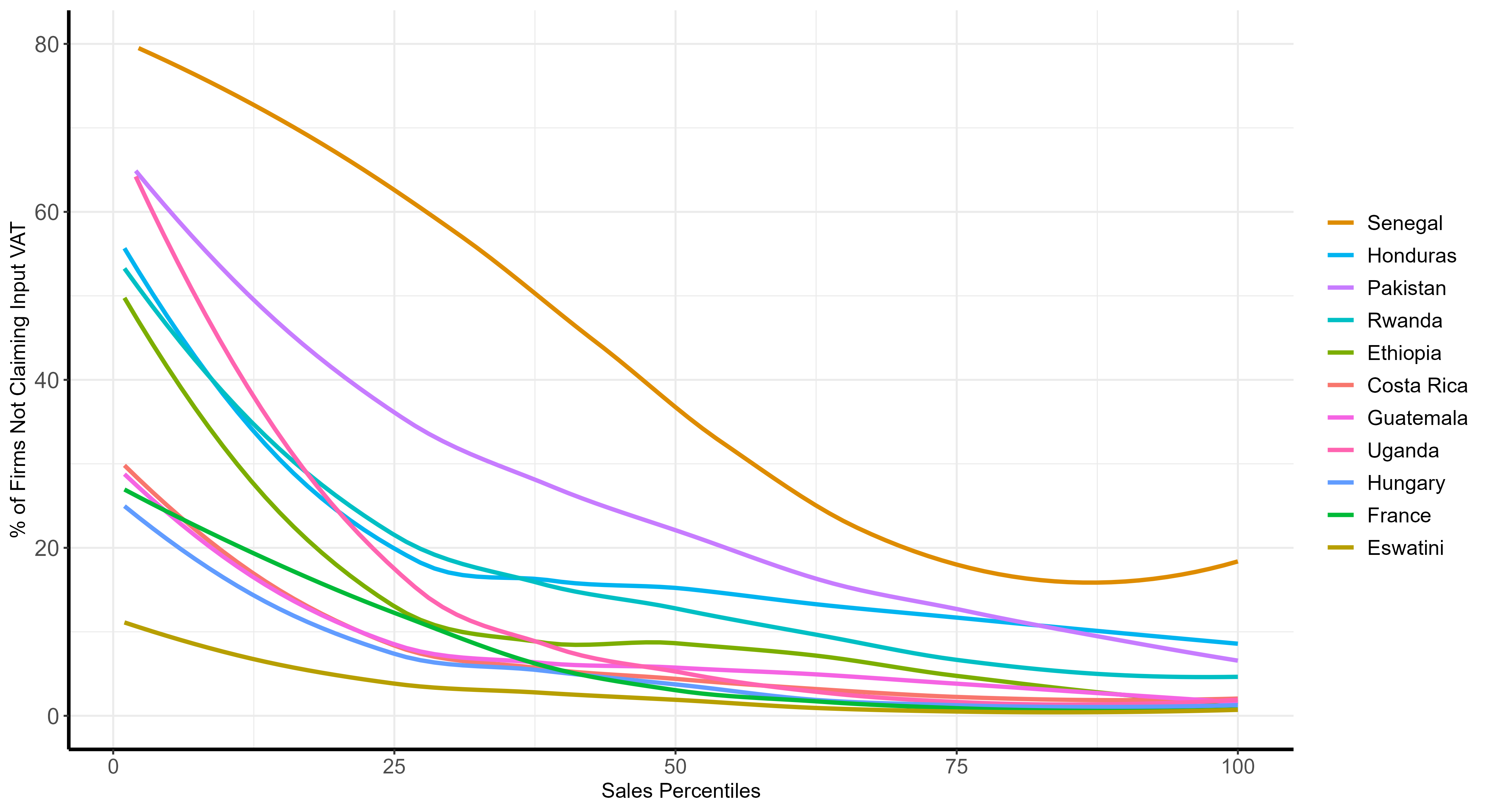

A similar problem arises with the non-claiming of inputs. The defining feature of a VAT is that firms can reclaim VAT paid on inputs. However, small firms, especially in developing countries, do not do so. As Figure 3 shows, around 40% of the smallest firms (those in the bottom 5% of the sales distribution) do not claim any input VAT. Again, this does not appear to be due to small firms operating in industries with few claimable inputs, as the result in Figure 2 holds within narrow industry bands.

Figure 3: Small firms are much more likely to not claim any input credits

The findings on effective tax rates and non-claiming of inputs seem to suggest that small firms are leaving money on the table by not claiming exemptions, reduced rates or inputs that larger firms in their sector do. Are these small firms naive? Possibly - evidence from focus groups suggests that small firms may not fully understand the rules, or find them too complicated to comply (Mascagni et al. 2022). At the same time, evidence from randomised audits has found that small firms evade much more than larger firms (Best et al. 2021, Bachas et al. 2022), and not claiming inputs/exemptions may be a way for small firms to avoid attracting the attention of the tax authorities.

VAT refunds

Another complex issue is that of VAT refunds, which has been described as the 'Achilles heel' of the VAT. A firm may be entitled to a VAT refund if its input credits exceed the VAT paid on its output, which typically occurs when firms are exporters and do not charge VAT on their output under the destination-based principle of the VAT. In high-income countries, where VAT refund systems generally work well, between 30 and 50% of gross VAT revenue is refunded (Pessoa et al. 2021). In lower-income countries, limited administrative capacity, the risk of fraud and the reluctance to forego revenue mean that firms have to wait months, if not years, to receive a VAT refund. Long refund delays have serious implications for businesses’ cash flows.

Our research is part of an emerging literature that has documented the difficulties of the VAT in low-income countries. For example, Gadenne et al. (2019) find that the VAT encourages firms in India to sort into formal and informal production networks. Almunia et al. (2022) find significant discrepancies in the value of sales reported by buyers and sellers for the same transaction in Uganda. Tourek (2022) document that firms in Rwanda often report exactly the same VAT liability each month, again possibly due to lack of knowledge or high compliance costs.

What are the alternatives?

There are two potential alternatives to the VAT: retail sales taxes and turnover taxes. We argue that neither of these taxes would be able to generate the revenue that a VAT does without substantial distortion, based on simple simulations.

Retail sales taxes only apply when a good is sold to a final consumer. If compliance is perfect, a retail sales tax is equivalent to the VAT, as a retail sales tax is charged on the full value of the good as it reaches the end of the supply chain, whereas a VAT is charged across the supply chain in proportion to each firm in the supply chain’s value added. However, in Pakistan (where access to transaction-level data allows us to identify the value of business to consumer sales), simple calculations show that a retail sales tax levied at the standard rate of VAT would raise at most 1/3 of VAT revenue, as the retail sector is diffuse, made up of small firms, and has high rates of evasion.

Turnover taxes are simply applied to all sales, regardless of whether they are business-to-business or business-to-consumer, and there is no deduction for input costs or tax paid on input. To generate the same amount of revenue as a VAT, our simulations show that the turnover tax rate would need to be in the range of 5-8%. These levels of turnover taxes would likely be highly distortionary – for example, a good that is passed from a wholesaler, to a distributor, to a retailer would be taxed on its entire value at least three times as it is sold three times before reaching the final consumer.

Moving to retail sales taxes or turnover taxes is clearly not the answer. Instead, governments should focus on reforms that make the VAT more efficient, given the policymaking constraints they face. Findings from cross-country administrative data have shed light on issues created by small firms in particular – they contribute little in revenue, yet they create distortions due to non-claiming of exemptions/reduced rates, whilst also having high rates of evasion. One policy option stemming from our research is to limit small firms’ exposure to the VAT entirely, either through high registration thresholds, or by effectively delegating collection responsibilities to large firms via VAT withholding, in which large firms are obligated to collect VAT on behalf of their suppliers (Brockmeyer and Hernandez 2022, Garriga and Tortarolo 2022).

References

Almunia, M, J Hjort, J Knebelmann, and L Tian (2022), "Strategic or Confused Firms? Evidence from 'Missing' Transactions in Uganda", The Review of Economics and Statistics, 1–35. https://doi.org/10.1162/rest_a_01180

Best, M, J Shah, and M Waseem (2021), "Detection Without Deterrence: Long-Run Effects of Tax Audit on Firm Behavior", Unpublished Working Paper.

Brockmeyer, A and M Hernandez (2022), "Taxation, Information, and Withholding: Evidence from Costa Rica", CEPR Press Discussion Paper No. 17716. https://doi.org/10.1596/1813-9450-7600

Brockmeyer, A, G Mascagni, V Nair, M Waseem, and M Almunia (2024), "Does the Value-Added Tax Add Value? Lessons Using Administrative Data from a Diverse Set of Countries", Journal of Economic Perspectives, 38(1): 107–132. https://doi.org/10.1257/jep.38.1.107

Diamond, P A and J A Mirrlees (1971), "Optimal Taxation and Public Production I: Production Efficiency", American Economic Review, 61(1): 8–27.

Ebrill, L P, M Keen, J-P Bodin, and V P Summers (Eds.) (2001), The Modern VAT, International Monetary Fund.

Gadenne, L, R Rathelot, and T Nandi (2019), "Taxation and Supplier Networks: Evidence from India", IFS Working Paper W19/21. https://doi.org/10.1920/wp.ifs.2019.1921

Garriga, P and D Tortarolo (2022), "Firms as tax collectors", IFS Working Paper 22/44. https://dtortarolo.github.io/WebPage/agip_networks.pdf

Mascagni, G, R Dom, F Santoro, and D Mukama (2022), "The VAT in practice: Equity, enforcement, and complexity", International Tax and Public Finance. https://doi.org/10.1007/s10797-022-09743-z

Pessoa, M, A K Okello, A Swistak, M Muyangwa, V Alonso-Albarran, and V Koukpaizan (2021), "How To Manage VAT Refunds", International Monetary Fund, How to notes.

Tourek, G (2022), "Targeting in tax behavior: Evidence from Rwandan firms", Journal of Development Economics, 158: 102911. https://doi.org/10.1016/j.jdeveco.2022.102911