When thinking about VAT incidence in countries with high registration thresholds it is important to consider the impact on VAT-unregistered firms. Their interaction with the VAT system matters for progressivity and introduces distortionary effects on product quality.

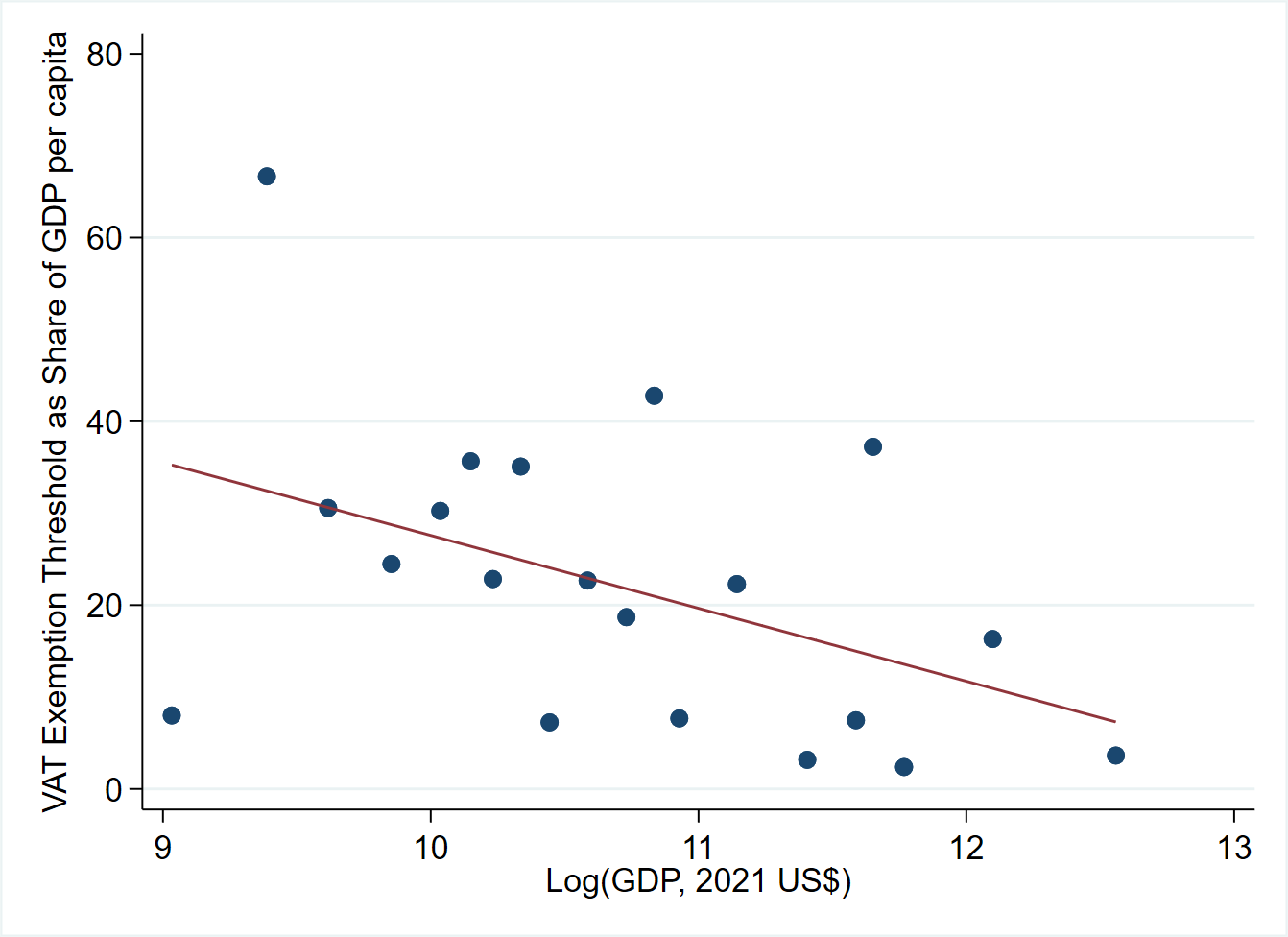

VAT systems are a key component of government revenue all around the world, playing a particularly crucial role in countries with low tax enforcement capacity. Most of these VAT systems feature a registration threshold: a sales revenue level above which VAT registration is mandatory. As Figure 1 shows, in low-income countries, this threshold tends to be placed relatively high in the firm size distribution to minimise administrative and compliance burdens (Keen and Mintz 2004). This size-based tax exemption creates a large, policy-driven untaxed sector that has a bearing on VAT efficiency and equity. As previous research has argued, because poorer consumers have a higher propensity to purchase goods from small, unregistered firms, exempting small firms can increase VAT progressivity (Jenkins et al. 2006, Gupta 2019, Bachas et al. 2020). However, the implications of this size-based exemption remain largely unexplored in existing theoretical and empirical work.

Figure 1: VAT Threshold Relative to Per Capita GDP by GDP in 2021

Source: Author’s calculations based on data from IMF RA-FIT and World Development Indicators

In countries where small firms take advantage of the size-based exemption, the progressivity of the VAT will depend on the extent to which goods sold by small, unregistered retailers are differentiated from those sold be registered firms. VAT incidence among unregistered firms is also impacted by the extent to which supply chains are segregated by registration status. Finally, in addition to the quantity of production, an increase in the VAT will affect the quality of goods produced. Examining these factors in the Indian context, we find that the VAT has little impact on prices at unregistered firms but does affect the quality of goods produced.

How do VAT-registered and -unregistered firms interact?

To illustrate the factors involved, first consider a VAT system with no size-based exemption, i.e. all firms are registered. In such a system, all business-to-business transactions generate input tax credits that exactly offset the VAT remitted by the seller. It is helpful to consider a concrete example to understand why this is true in the standard input-tax credit mechanism. Suppose a registered baker purchases $40 worth of flour from a registered miller to produce bread that the baker sells for $100 to the final consumer, therefore adding $60 of value. At a VAT rate of 10 percent, the miller must remit $4 in VAT to the government and the baker receives $4 of input tax credit. The baker must then remit $10 of VAT on its sale to the final consumer and does so using the $4 in input tax credit and an additional $6 in cash (i.e. 10 percent of their value-added).

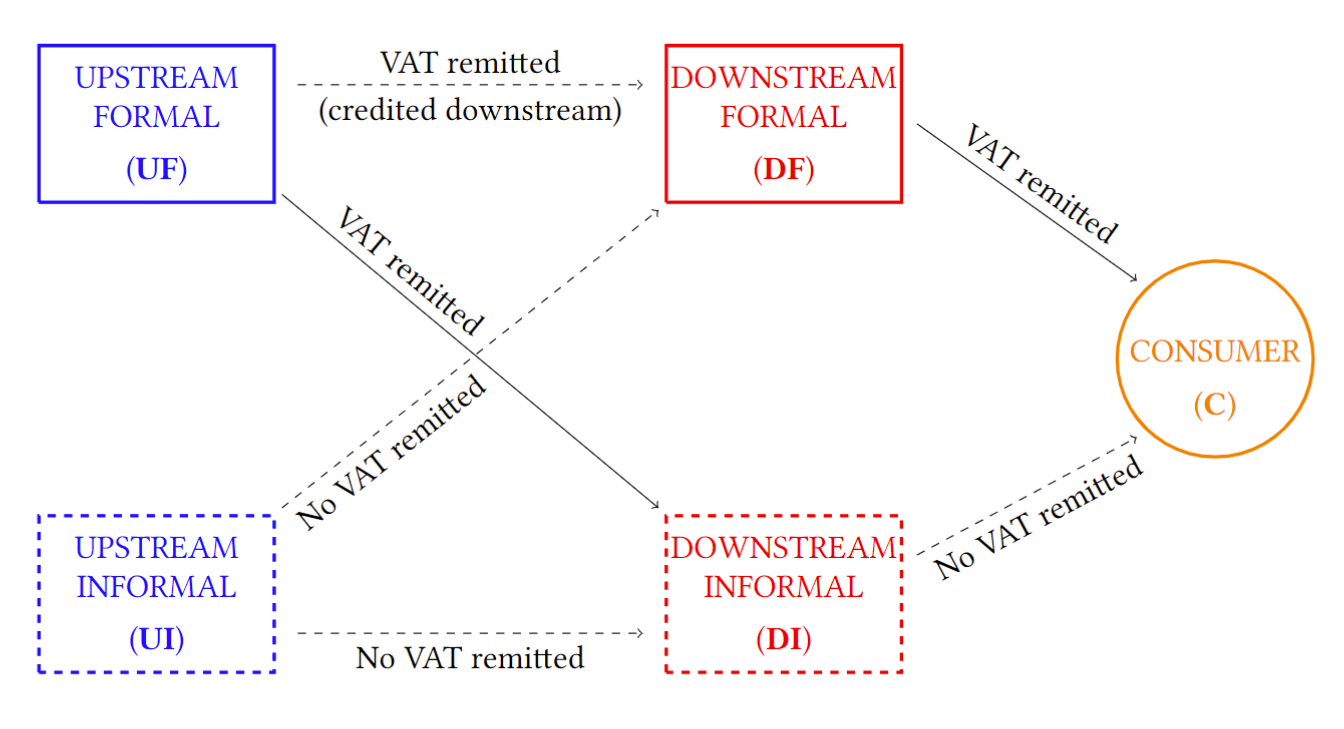

Figure 2 illustrates the possible links among firms in a VAT system. With no informal sector the figure would consist of only the consumer, the upstream formal (UF) and downstream formal (DF) firms. Since VAT liabilities upstream are exactly offset by input tax credits, there is a net tax liability only at the final retail stage and tax pass-through is identical to that of a retail sales tax with the same rate as the VAT.

Figure 2: VAT liabilities in a VAT system with registered and unregistered firms

The exemption threshold introduces supply chain considerations. Both upstream and downstream firms can be unregistered (UI and DI, respectively, in Figure 2). Transactions between upstream formal firms and downstream informal firms (UF-DI) also result in tax remitted without input tax credits, similar to final stage transactions. In the previous example, if the baker were unregistered, the miller would still have to remit $4 in VAT on their sale of flour but the baker would not receive any input tax credit and would not have to remit any tax on their bread sales. This is a feature of the VAT – the government is able to capture revenue on at least part of the value added of final goods sold by unregistered firms.

VAT systems with an informal sector thus present two channels through which VAT could pass through to informal sector prices. First, if informal firms buy inputs from formal firms, they might pass some of this tax burden onto their consumers, following the path UF-DI-C in Figure 2. Second, VAT imposed at the final consumption stage might generate responses in the demand for the informal variety. If consumers are willing to switch between formal and informal varieties of the same product, DF-C transactions could influence the prices charged for DI-C transactions. When registered and unregistered bakers are similar in the bread they produce, consumers might respond to a VAT hike on bread by switching their consumption from registered to unregistered bakers, driving up demand, and therefore prices, for unregistered-produced bread.

Pass-through to unregistered firms: the case of the CenVAT

In our research (Brusco and Velayudhan 2023), we study these different channels through which a VAT can impact prices at registered and unregistered firms in the context of the Indian CenVAT, a manufacturing-focused predecessor of the current VAT system in India. Under the CenVAT, goods were subject to a wide variety of tax rates which were frequently changed, allowing us to use a two-way fixed effects specification that exploits exogenous changes in commodity-level CenVAT rates. The exemption threshold in the CenVAT was set at Rs. 10 million initially and moved up to Rs. 15 million in 2008, corresponding to about $200,000 and $300,000 respectively at 2008 exchange rates.

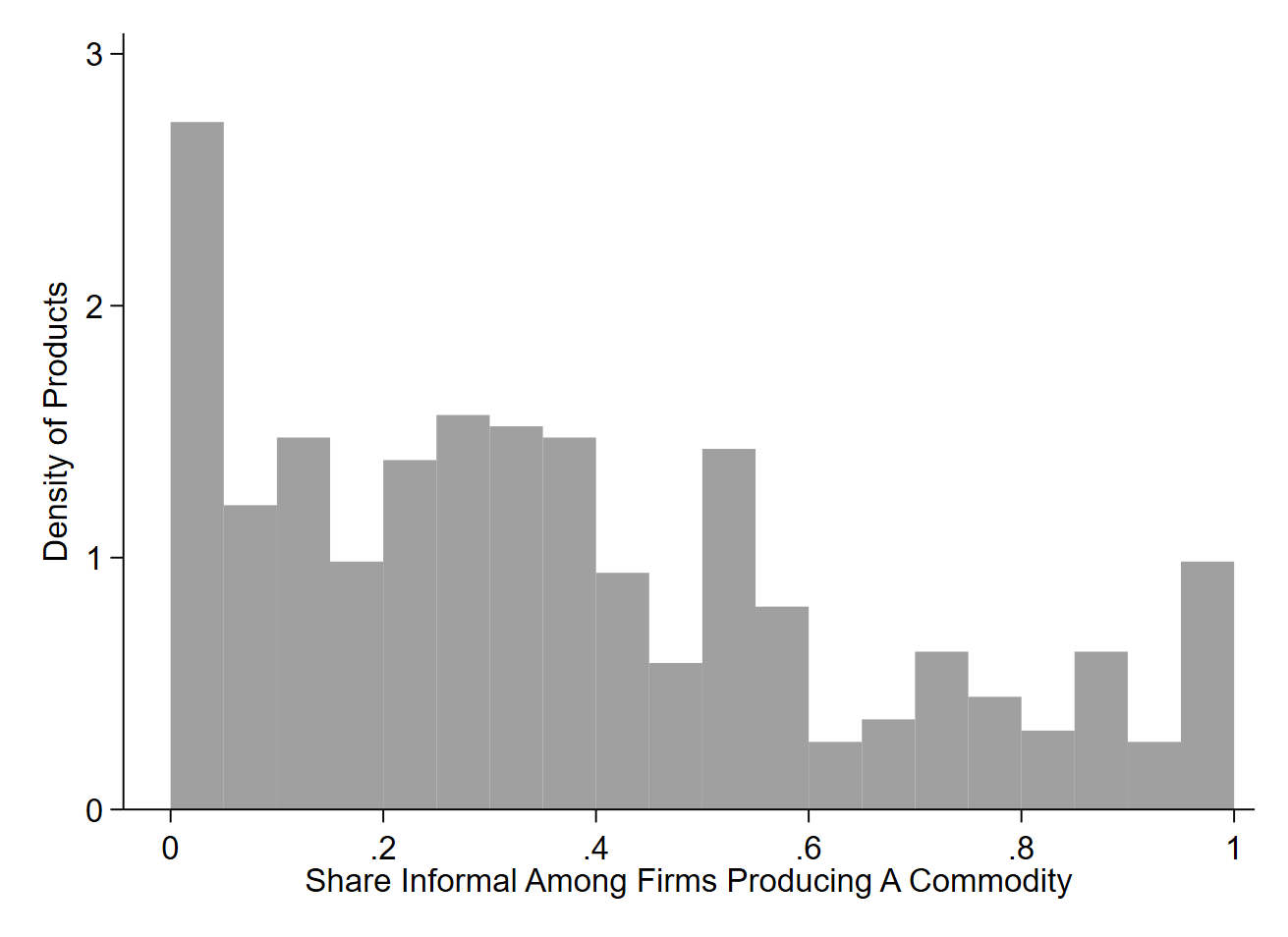

Firms producing the same commodity, even within the fine 7-digit commodity codes that we use, can vary greatly in size. Figure 3 shows the the share of firms producing a commodity that are below the exemption threshold for final-consumption goods. A value of 1 would indicate that the commodity is entirely produced by informal firms. Although firms below the threshold tend to be much smaller than registered ones, they are very numerous: in the median commodity market, more than 30% of all firms are below the threshold.

Figure 3: Distribution of Small-Firm Share in Production of Commodities

Source: Author’s calculations based on data from the Annual Survey of Industries, 2004-2014.

This variation in size likely mirrors deeper forms of unobservable heterogeneity. For instance, firms producing the same commodity might differ in the quality of inputs used, manufacturing process, customer service, or a number of other ways relevant to consumers. Indeed, previous research that was able to observe firm-to-firm linkages found the lack of input-tax credits for unregistered firms created incentives to sharply segment supply chains between registered and unregistered firms (DePaula and Scheinkman 2010, Liu et al. 2019, Gadenne et al. 2019). This might also be the reason why we find that taxes at the input stage raise input costs but are not passed through to output prices.

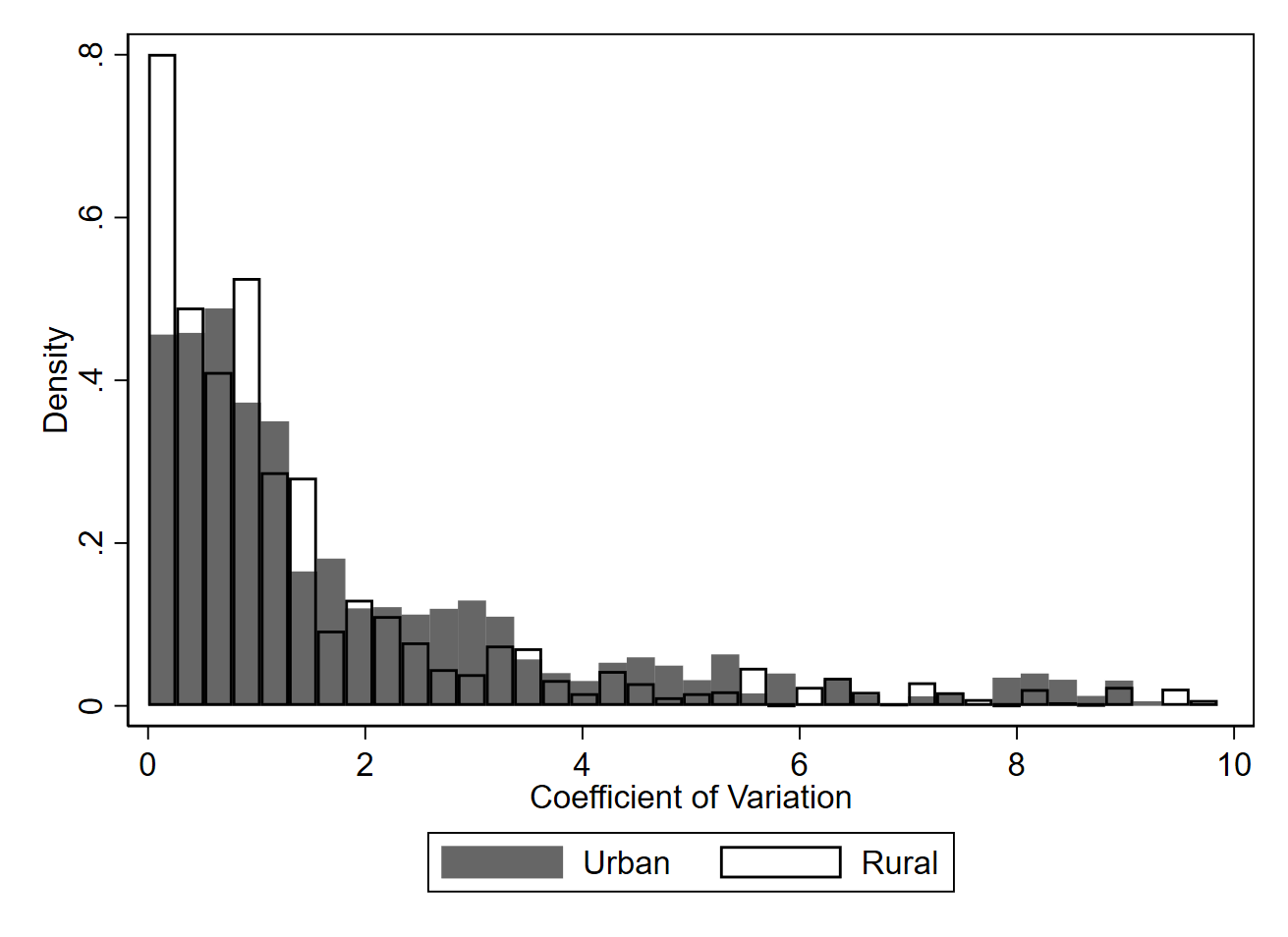

Product differentiation within commodity codes is also evidenced by the fact that firms charge different prices for the same commodities. Figure 4 shows two facts in this regard. First, that some commodities have immense variation in prices. Second, it shows that in urban areas there is substantially more price variability - and presumably, more product differentiation - than in rural areas. This can be explained by the fact that urban areas, which are richer and more varied, have a stronger taste for variety.

Figure 4: Price Dispersion in Urban and Rural Areas

Source: Author’s calculations based on data from the Annual Survey of Industries, 2004-2014.

The fact that goods in rural areas display less product differentiation means that consumers are more willing to substitute one product variety with another. In turn, this means that when the VAT rate changes for varieties produced by registered firms this is more likely to impact demand for unregistered varieties, driving up their price. This implies that rural customers of unregistered firms bear some of the burden of VAT even if they shop at firms that are not directly affected by it. This result is particularly concerning given that rural regions also tend to be poorer on average, meaning VAT is more regressive than what one might assume given consumption patterns.

Distortions of quality

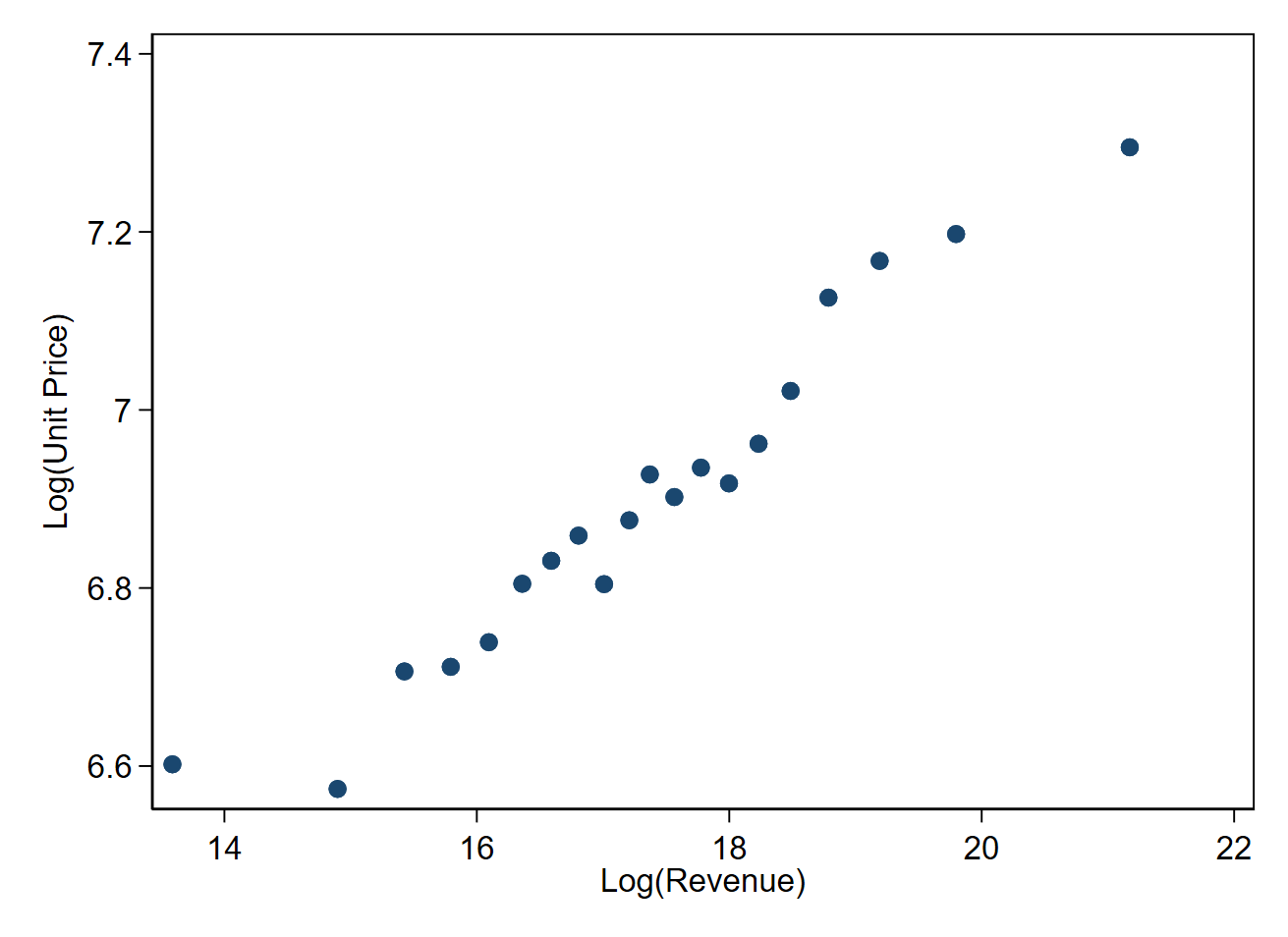

If indeed firms differentiate in the varieties of goods they produce, then how does the VAT system impact the distribution of quality? We can start from a simple fact: bigger firms make better products on average. Figure 5 shows that, adjusting for commodity fixed effects, firms with higher revenue also tend to sell their output for a higher price.

Figure 5: Price and Firm Size

Source: Author’s calculations based on data from the Annual Survey of Industries, 2004-2014.

A higher VAT rate on output will generally induce affected firms to become smaller, pushing marginally-registered firms to de-register. This, in turn, will affect the composition of goods traded above and below the threshold. The average price among firms that are induced to de-register changes because an VAT increase on output induces the lowest-quality firms, which tend to be the smallest in the registered sector, to become the highest-quality firms in the unregistered sector. This phenomenon raises the average price in both sectors, on top of what one would predict with simple tax pass-through.

This effect is sizeable: according to our estimates, one-third of the change in average prices in response to a VAT rate change is due to the changing composition of quality traded by registered and unregistered firms respectively. This highlights a previously unexplored distortion of VAT in the presence of high registration thresholds: changes that induce de-registration also result in a tax-advantaged treatment of lower-quality varieties.

References

Bachas, P, L Gadenne, and A Jensen (2020), "Informality, consumption taxes, and redistribution", NBER Working Paper No. 27429.

Brusco, G and T Velayudhan (2023), "Does the Informal Sector Escape the VAT?", Working Paper.

DePaula, A and J A Scheinkman (2010), "Value-added taxes, chain effects, and informality", American Economic Journal: Macroeconomics, 2(4): 195–221.

Gadenne, L, T K Nandi, and R Rathelot (2019), "Taxation and supplier networks: evidence from India", CEPR Discussion Paper DP13971.

Gupta, A (2019), "Firm Heterogeneity, Demand for Quality and Prices: Evidence from India", Working Paper.

Jenkins, G P, H Jenkins, and C-Y Kuo (2006), "Is the Value added tax naturally progressive?", Working Paper.

Keen, M and J Mintz (2004), "The optimal threshold for a value-added tax", Journal of Public Economics, 88(3-4): 559–576.

Liu, L, B Lockwood, M Almunia, and E H F Tam (2019), "VAT notches, voluntary registration, and bunching: theory and UK evidence", Review of Economics and Statistics: 1–45.