Evidence from Mauritius shows the consequences of losing a formal job in a labour market characterised by high rates of informal employment are significant. Unemployment benefits help mitigate these effects, while generating only small disincentive effects on labour supply.

Only around half of middle-income economies and few low-income economies have public unemployment benefit (UB) schemes (see Gerard and Naritomi 2021, Asenjo et al. 2024). This is partly due to an understanding that informal jobs are readily available to individuals dismissed from formal jobs in low- and middle-income countries, and that these informal jobs represent good substitutes of the formal jobs lost (e.g. offering adequate wages). According to this logic, providing insurance against formal job loss through UBs has little value, while concerns are amplified that UB recipients might draw UBs for longer while at the same time working informally.

In recent research, we test this hypothesis by providing the first unified estimates of welfare effects of UBs in a context of high informality (Liepmann and Pignatti 2024). We define these welfare effects as the trade-off between the insurance value and the efficiency costs of UBs, as formulated in job search models (Baily 1978, Chetty 2008, Gerard and Gonzaga 2021). The insurance value captures welfare gains as UBs help dismissed workers stabilise their consumption at layoff. The efficiency costs refer to longer UB receipt and delayed re-entry into formal employment stemming from increased UB generosity. Contrary to the general understanding of the role of UBs in highly informal labour markets, we find positive welfare effects that are larger than in high-income countries.

The innovation of our study is that we match the full social security records of UB recipients (i.e. tracking the entire employment history in the formal labour market) with household survey data for a representative sub-sample of UB recipients. This allows us to study the extent to which UB recipients move to informal employment after formal job loss, and the implications of this shift for future employment trajectories, earnings, transfers, and consumption. We thus assess if the presence of informal jobs makes UB provision more or less needed, compared to contexts where labour informality is low.

The country context

Our analysis is conducted for Mauritius, a country in the Indian Ocean with a population of 1.3 million and a level of economic development comparable to Argentina, Brazil or Uruguay. In Mauritius, an estimated 56% of all employed work informally. Dismissed individuals can obtain UBs for a maximum of 12 months after job loss. Programme eligibility ends when an individual re-enters employment, but this can be enforced only for formal re-employment.

The consequences of formal job loss

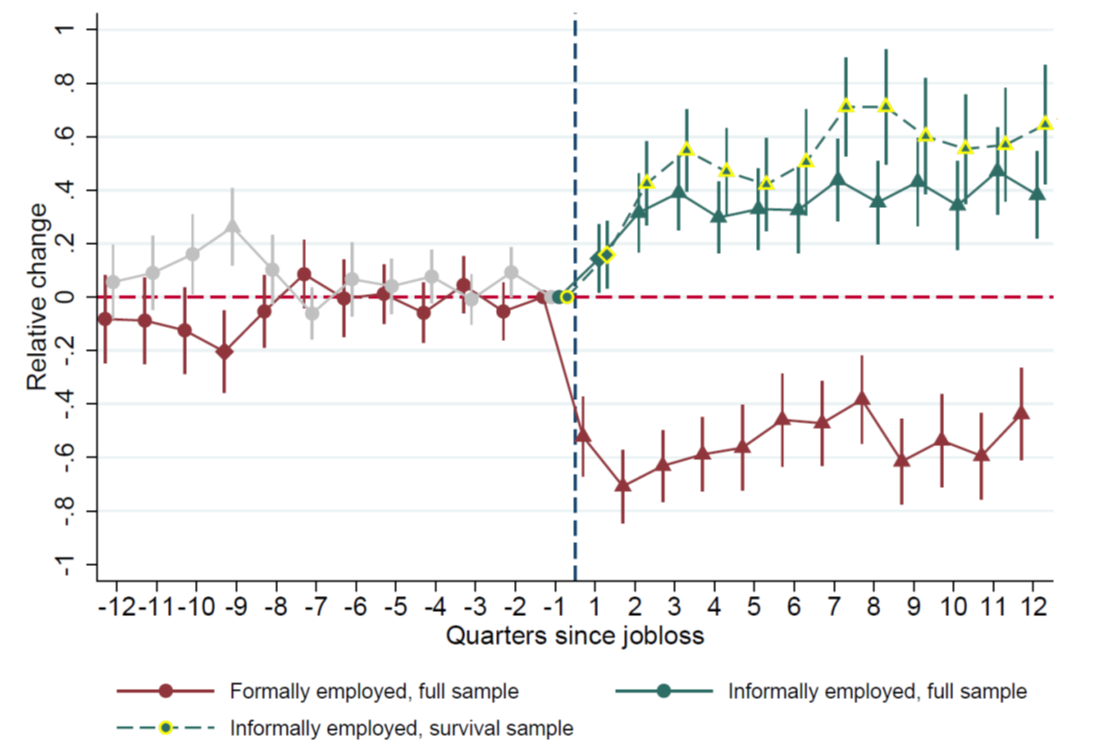

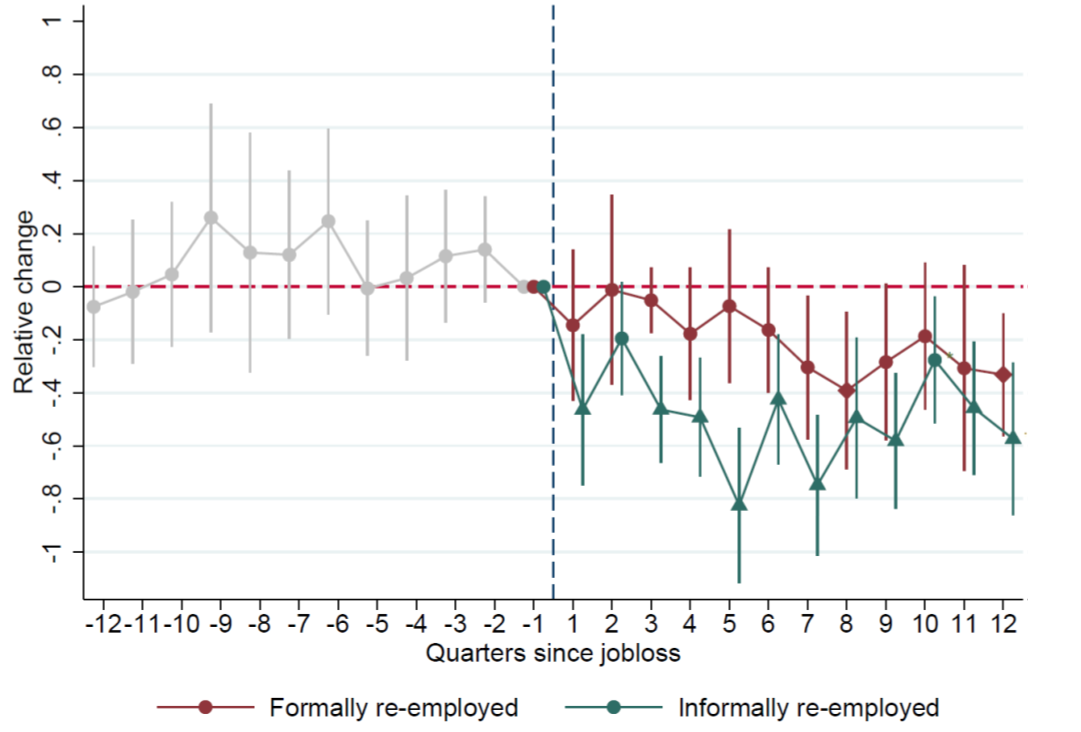

To study the effects of formal job loss, we conduct a difference-in-differences (DiD) analysis in a six-year window around job loss, using as a control group individuals who never lost their formal job. We find that, after the loss of a formal job, UB recipients transition rapidly to informal employment. Importantly, the shift towards informal employment is of long-term nature and does not end with UB eligibility (i.e. one year after job loss, when any possible disincentive for formal re-employment associated with UBs terminates). Rather, even three years after job loss, UB recipients are still around 40% more likely to hold an informal job (Figure 1, Panel A). This is explained by a roughly equal shift towards informal dependent employment and informal self-employment. While the presence of informal employment allows UB recipients to rapidly regain employment, it is also associated with a substantial earnings penalty. Earnings fall for both formally and informally re-employed individuals, but the effect is much stronger for those who find an informal job (Figure 1, Panel B). We interpret this as evidence that UB recipients move to informality in the absence of better job opportunities in the formal economy, rather than as a strategic choice to receive UBs for longer.

Figure 1: DiD results on employment and monthly earnings by formality A) Employment B) Monthly earnings

A) Employment

B) Monthly earnings

Note: The figure presents difference-in-differences estimates for the effects of job loss on employment and monthly earnings, comparing UB recipients with a control group of workers who kept a formal job. Confidence intervals refer to the 90% level; significance at the 5 and 1% levels are illustrated by markers shaped in diamond and triangle form, respectively. In Panel A, the “survival sample” includes in the treatment group only individuals who are not yet formally re-employed. The sub-group is of interest as these individuals are entitled to UB receipt until benefit exhaustion.

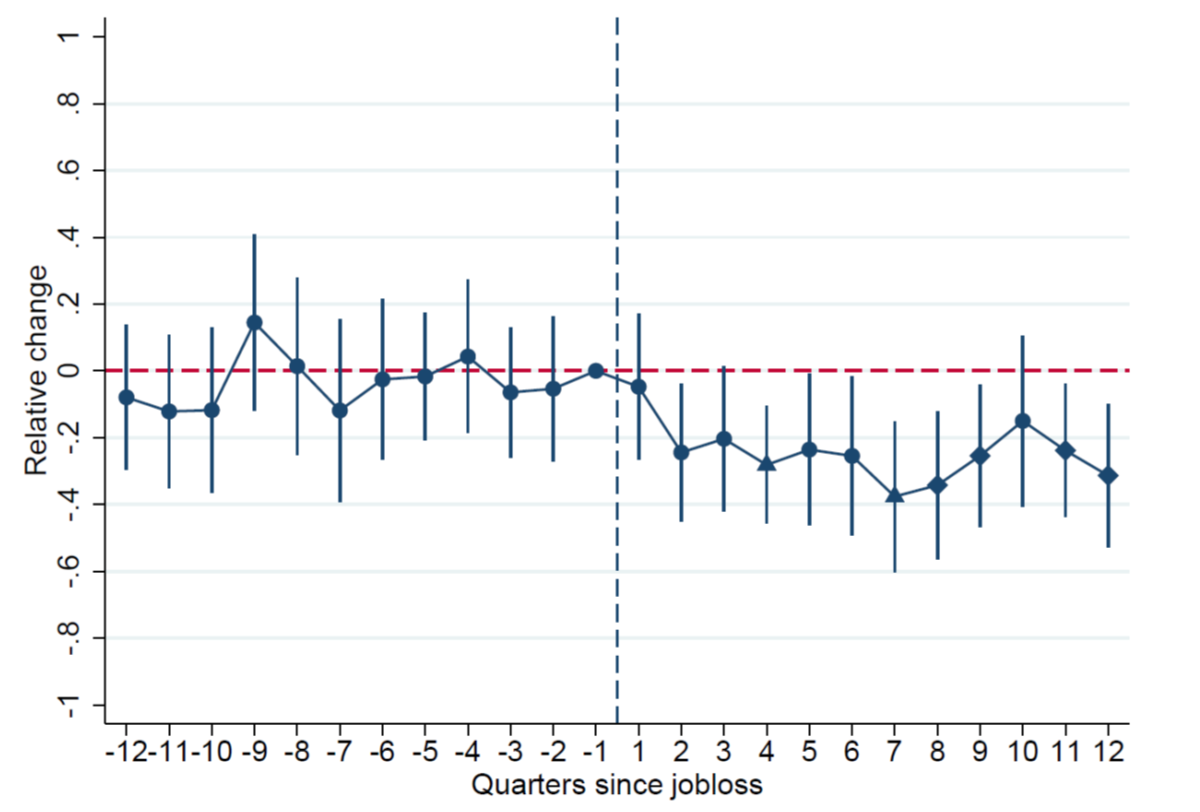

In our research, we also document that individuals cannot resort to other types of transfers (e.g. from relatives or other forms of social assistance) when UB eligibility ends. Given that earnings remain substantially below their pre-layoff levels even long after individuals stop receiving UBs, we can anticipate a significant contraction in consumption. This is confirmed by the data, as consumption expenditures decrease by between 20 and 30% even three years after job loss (Figure 2). The drop in consumption is larger for durable compared to non-durable goods (mostly food), but both consumption types decline. In comparison, our estimated consumption drop is between three to six times larger than the ones found for developed economies (Schmieder and von Wachter 2016). It therefore implies a comparatively large insurance value of UBs.

Figure 2: DiD results on total expenditures

Note: The figure presents difference-in-differences estimates on the effects of job loss on total expenditures, comparing UB recipients with a control group of workers who kept a formal job. Confidence intervals refer to the 90% level; significance at the 5 and 1% levels are illustrated by markers shaped in diamond and triangle form, respectively.

The efficiency costs of UBs

We then turn to estimating the efficiency costs of UBs. Despite the results presented so far, the large insurance value of UBs could be offset by even larger efficiency costs, generating overall negative welfare effects.

To estimate the efficiency costs, we exploit the presence of an upper bound to benefit levels, which generates exogenous variations in the replacement rate (i.e. individuals who are entitled to UBs above the upper bound receive, in relative terms, less generous UBs). Adopting a regression kink design, we find an elasticity of the length of UB receipt to benefit levels that ranges between 0.26 and 0.47. This means that a 10% increase in benefit levels increases the length of UB benefit receipt by around 3 to 5%. The elasticity of time until formal re-employment to benefit levels ranges between 0.76 and 1.45. These estimates are within the range of those found in developed economies. Only when taking our more extreme estimates, we find labour supply responses that are slightly larger than the median from previous studies (Schmieder and von Wachter 2016).

What does this mean for policy?

The relatively large insurance value of UBs, and efficiency costs that are instead in line with those in previous studies, translate into welfare effects of UBs that are larger than those found for UBs in developed economies. Even when we take the more conservative estimates, we find positive welfare effects from increasing UB generosity. Similar conclusions arise when computing the marginal value of public funds, for which our estimates are larger than the median value in previous studies on UBs (Hendren and Sprung-Keyser 2020).

Understanding the role of informal jobs is key to interpreting our, perhaps surprising, results. The strong and persistent increase in informal employment after dismissal is a response to the layoff event, while the incentives are limited to move into informality when UBs increase. Associated with decreased earnings and inadequate consumption levels, the lower-quality informal jobs represent an unsuitable means of insurance against the risk of dismissal. Instead, providing public insurance through UBs appears to be a sensible policy option.

References

Asenjo, A, V Escudero, and H Liepmann (2024), “Why should we integrate Income and Employment Support? A conceptual and empirical investigation.” The Journal of Development Studies 60(1): 1-29.

Baily, M N (1978), “Some Aspects of Optimal Unemployment Insurance”. Journal of Public Economics 10(3): 379–402.

Chetty, R (2008), “Moral Hazard and Liquidity in Optimal Unemployment Insurance”. Journal of Political Economy 116(2): 173–234.

Gerard, F and G Gonzaga (2021), “Informal Labor and the Efficiency Cost of Social Programs: Evidence from the Brazilian Unemployment Insurance Program”. American Economic Journal: Economic Policy 13(3): 167-206.

Gerard, F and J Naritomi (2021). “The value of job displacement insurance in developing countries: Evidence from Brazil” VoxDev.org, 22 February.

N Hendren and B Sprung-Keyser (2020), “A unified welfare analysis of government policies”.

Quarterly Journal of Economics 135(3), 1209–1318

Liepmann, H and C Pignatti (2024), “Welfare Effects of Unemployment Benefits When Informality Is High”. Journal of Public Economics 229: 105032.

Schmieder, J and T von Wachter (2016), “The Effects of Unemployment Insurance Benefits: New Evidence and Interpretation”. Annual Review of Economics 8: 547–81.