In contexts where information on new financial technologies is limited, publicly disclosing an agent’s financial incentives negatively impacts take-up

The underutilisation of new beneficial technologies is considered one of the key constraints to productivity growth (Parente and Prescott 1994, Caselli and Coleman 2001, Comin and Hobijn 2004). Understanding how to increase the adoption of these technologies is thus a central issue in economics.

New technologies are often promoted by local agents, who work to inform the population about their potential benefits and promote their take-up. To understand how to maximise technology adoption, one must carefully consider not only how to incentivise local agents to exert more effort in the promotion of new technologies, but also how to ensure that this extra effort translates into higher take-up.

In a recent study (Deserranno, León-Ciliotta, and Witoelar 2021), we examine the design of financial incentives offered to local agents for acquiring new clients, showing how the level of these incentives affects agent effort and technology adoption. Crucially, we examine whether making incentives transparent (i.e. disclosed to the community) affects take-up.

Branchless banking agents

Branchless banking agents are typically business owners with an existing clientele (for example, shop owners, restaurant owners, cell phone top-up stations) and are asked to promote savings accounts as a side job. They do not receive a fixed wage from the bank and are paid a commission for each new customer who signs up for an account and for each transaction made. Agents are responsible for promoting the take-up and usage of the new savings account in their villages, identifying new clients, and supporting existing ones.

The effort and signalling effects of financial incentives

Financial incentives in the form of higher commissions can be used to boost the effort branchless banking agents put into finding new clients, therefore increasing take-up of the financial products they are promoting. However, in contexts where low information and low trust in new technologies are prevalent, potential users rely on different heuristics and cues to make inferences and decide on their willingness to take up these products.

Financial incentives offered to local agents for attracting new users can thus also affect demand by conveying a signal about the quality of the product or the intentions of the agent. Higher incentives can be interpreted as a signal that the agent has a high opportunity cost, or that the product's provider is successful (thus potentially reinforcing the product's demand). Alternatively, higher incentives can be interpreted as a signal that the agent is primarily motivated by money (as opposed to prosocial reasons) and is more likely to take advantage of an uninformed consumer (hampering the product's demand).

If such signalling effects are present, the success of raising agents' financial incentives to boost take-up crucially depends on the transparency of the latter – the extent to which potential users are aware of the agent compensation level – and how the signal is interpreted. If incentives are privately known by the agent but not the community, raising their level can have a positive supply effect on take-up by prompting agents to exert more effort without triggering any demand-side signalling effect. If, instead, incentives are public information (known by the agent and the community), the effect of raising them on take-up is ambiguous. If higher incentives convey a positive signal about the product to potential customers, then disclosing their level should boost take-up even more. In contrast, if they convey a negative signal about the product, disclosing their level may deteriorate demand perceptions and attenuate (or even reverse) the positive supply effect.

Experimental design

In collaboration with a large bank in Indonesia, we designed an experiment to separately identify the effort and signalling effects of financial incentives for branchless banking agents. The evaluation takes place in rural East Java, a context ideally suited to study whether financial incentives affect demand perceptions through a signalling channel: the population is highly unbanked, branchless banking is largely unknown, and the level of trust in financial institutions is limited. Such characteristics imply that potential customers will rely on different heuristics (for example, agents' incentive levels) when evaluating the products' benefits and their willingness to adopt them.

Each of the 401 villages in our sample is served by a locally recruited agent. Our experimental design has two layers:

- Exogenous variation in incentives: In the low-incentives treatment, agents are paid 2,000 IDR (US$0.14) for each customer who signs up for a savings account (the status-quo), while they are paid 10,000 IDR ($0.71) in the high-incentives treatment.

- Exogenous variation in transparency: In the public incentives treatment, potential customers are informed about the agent's incentive level while in the private incentives treatment this information is not disseminated.

Higher financial incentive increases take-up and usage, if information about the incentive is private

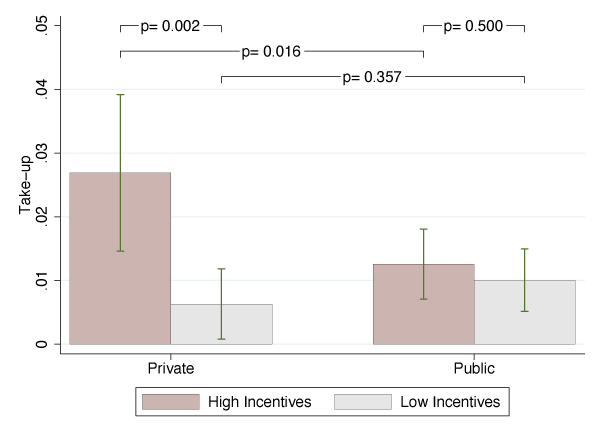

Using the survey and the bank’s administrative data, we find that, when information on incentives is private, raising their level more than triples the take-up of new financial products. This corresponds to a 2 percentage point increase in take-up, as shown in the two bars in the left of Figure 1. Additionally, we observe a corresponding increase in the product’s usage – total amount of deposits/withdrawals, account balance, and savings go up by 18–20%.

Figure 1 Take-up of the bank’s branchless banking products

Note: This figure presents the means and the 95% confidence intervals of the take-up rate by treatment group. The two bars on the left (right) display the means when incentives are private (public). The top horizontal bars show p-values for t-tests of equality of means between different treatment groups.

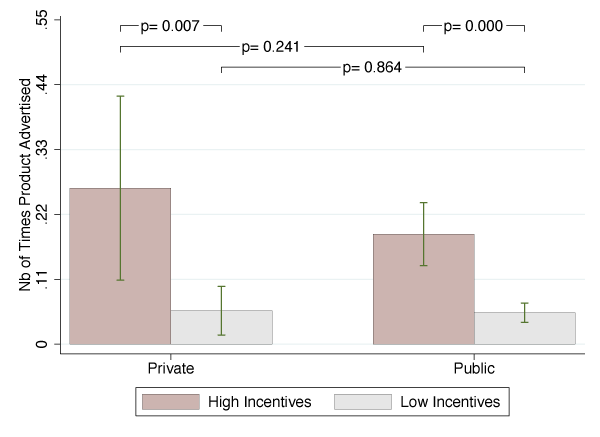

The increase in take-up is explained by an increase in agents’ effort, which we measure using survey data from potential customers in the village. Agents who receive higher incentives promoted the product more proactively, and potential clients were more likely to be aware about the existence of the product (see the two bars in the left in Figure 2).

Figure 2 Effects on agent effort

Note: This figure presents the means and 95% confidence intervals of the number of times the agent advertised the product to the household by treatment group. The two bars on the left (right) display the means when incentives are private (public). Top horizontal bars show p-values for t-tests of equality of means between different treatment groups.

Public information about the agent’s compensation sends a negative signal to potential clients

The aforementioned positive effects of higher financial incentives on take-up and usage entirely disappear when information on agent compensation is made public knowledge (see the two bars in the right in Figure 1). Importantly, this is not explained by agents’ responses, as agents exert a similar amount of effort whether incentives are private or public (see the red bars in Figure 2).

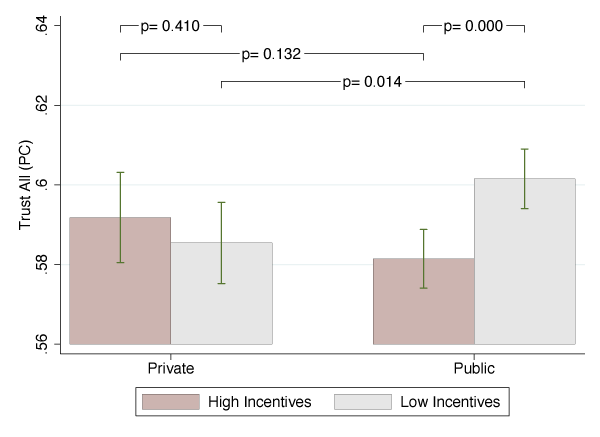

Rather, this shift is explained by a signalling effect on potential customers’ perceptions. We show this using survey data on respondent’s perceptions about the reliability and trustworthiness of the agent, the product, and the bank. In the two bars in the right of Figure 3, we see that potential clients’ perceptions deteriorate when incentives are high and this information is public (compared to the low public treatment). These results are entirely driven by clients who have low baseline levels of trust in the agent and lack of information about the products.

Figure 3 Potential clients’ perceptions: Trust in product, agent, and the bank

Note: This figure presents the means and the 95% confidence intervals of trust in the products, agent, and bank (principal component of four product trust questions, four agent trust questions, three bank trust questions). The two bars on the left (right) display the means when incentives are private (public). The top horizontal bars show p-values for t-tests of equality of means between different treatment groups.

Discussion

Our results reinforce previous evidence in the literature on the effectiveness of financial incentives in prompting local agents to exert more effort in promoting new products. However, in contexts where information about new technologies is limited, potential users rely on different observable cues to inform their willingness to take them up, and public information about financial incentives may provide a meaningful signal about the quality and trustworthiness of the new product. In our setting, the positive effects of higher agent incentives on take-up only materialise if these incentives are kept private. When they become public information, raising their level does not increase take-up, thus wasting the organisation's resources, as well as agents' time and energy in promoting the products.

From a policy standpoint, organisations promoting new technologies need to carefully consider the signals they send to potential clients, as these end up shaping the demand for their products. Specific attention should be paid to the transparency of financial incentives along with their level. High incentives should be kept private information whenever these convey a negative signal to potential clients. In contrast, where low financial incentives convey a positive signal, they should be disclosed to the community.

References

Comin, D and B Hobijn (2004), “Cross Country Technology Adoption: Making the Theories Face the Facts”, Journal of Monetary Economics 51: 39-83.

Caselli, F and W J Coleman (2001), “Cross-Country Technology Diffusion: The Case of Computers”, The American Economic Review 91(2): 328–35.

Deserranno, E, G León-Ciliotta and F Witoelar (2021), “When Transparency Fails: Financial Incentives for Local Banking Agents in Indonesia”, CEPR Discussion Paper 15714.

Parente, S L and E C Prescott (1994), “Barriers to Technology Adoption and Development”, Journal of Political Economy 102(2): 298–321.