Demand for insurance is high even at the actuarially fair price and receiving it alongside peers increases utilisation, yet health effects are elusive

Household financing of healthcare in developing countries is a significant challenge, especially for low-income families. In 2018, households in India paid 62% of health expenditures out-of-pocket (World Health Organisation 2021). Many households are pushed into poverty by high health costs, and care is often foregone due to financial concerns (Berman and Ahuja 2008).

India’s national health insurance scheme

To address these challenges, the Indian government in 2008 launched a publicly financed, national hospital insurance programme for households below the poverty line, named the Rashtriya Swasthya Bima Yojana (RSBY). The programme provided insurance largely for free. This decision was based, in part, on the concern that cost-sharing would reduce enrollment; however, uptake remained below 100% even with a nominal premium (Berg et al. 2019, Rathi et al. 2012).

Moreover, utilisation among enrollees was relatively low (Garg et al. 2020). Had enrollment and utilisation been high, the fiscal cost would have been much greater, a common criticism of publicly-financed health-insurance schemes in countries with low fiscal capacity (Oxfam 2008). Finally, the health impacts of insurance access are poorly understood. This experience raises several pressing questions.

Understanding insurance pricing, utilisation, and impact on health outcomes

First, could lower-middle-income countries like India reduce pressure on public finances by offering the opportunity to buy actuarially fair insurance without subsidies, without reducing programme uptake? Second, why was healthcare utilisation low among the newly insured? As with other new technologies, individuals (and even providers) may not know how to use it. Adoption may be slow and subject to learning-by-doing and spillovers, as individuals learn from other users. And finally, does health insurance improve health in lower-middle-income countries?

To address the questions above, we conducted a large randomised controlled trial between 2013 and 2018 to study the impact of expanding hospital insurance eligibility under RSBY (Malani et al. 2021). The experiment offered households above the poverty line, who lacked hospital insurance, access to RSBY. The study was conducted in the state of Karnataka. The sample included 10,879 households (comprising 52,292 members) in 435 villages, making this amongst the largest health insurance experiments ever conducted.

Methodology

Treatment varied at two levels. First, sample households were randomised to one of four treatments:

- Free RSBY insurance

- The opportunity to buy RSBY insurance at the actuarially fair price

- The opportunity to buy RSBY insurance, along with an unconditional cash transfer equal to the RSBY premium

- No intervention (control group)

These different treatments allow us to determine how premia affect uptake, and to shed light on the trade-off between greater uptake and higher government expenditure on insurance premium subsidies. The fraction of sample households in each village that were randomised to each insurance access option was varied at random. This allows us to estimate within-village spillovers from households that get access to insurance on enrollment of other households, and from households that enroll in insurance on utilisation of other households.

This spillover may be important through several potential channels. Because insurance is a relatively new product in India, neighbours’ experience may affect enrollment or utilisation (Chatterjee et al. 2018, Debnath and Jain 2020). Alternatively, limited supply of beds may affect access for households if neighbours’ utilisation is high relative to capacity.

The study included a baseline survey involving multiple members of each household, that was conducted 18 months before the intervention. The intervention lasted from May 2015 to August 2018. Outcomes were measured twice, at 18 months and 3.5 years after the start of the intervention, to allow us to study both the short-term effects of insurance and the longer-term ones. These two sets of outcomes may differ for various reasons, including learning-by-doing, the accumulation of health benefits from medical care (Black et al. 2017), negative experiences that lead households to stop utilising insurance, or crowd-out or congestion that builds up over time.

Even without subsidised prices, there is relatively high uptake of insurance

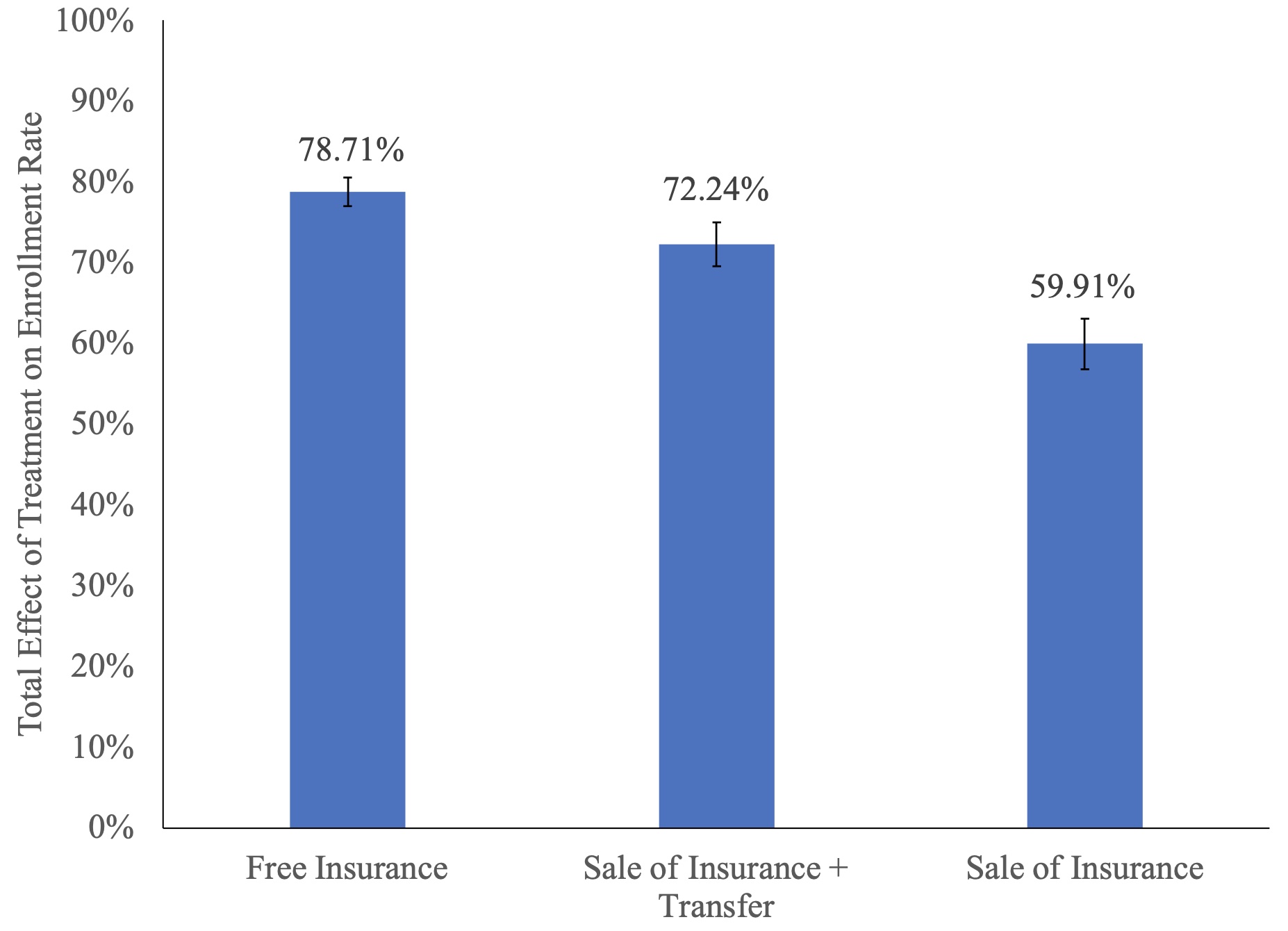

A primary finding is that unsubsidised sale of insurance achieves relatively high uptake: accounting for spillover effects, the option to buy RSBY insurance increased uptake by 59.91% relative to the control group, while the unconditional cash transfer increased utilisation to 72.24% and the conditional subsidy to 78.71% (Figure 1).

Figure 1 Effects of insurance access on insurance enrollment

Utilisation of insurance: Spillovers matter, and early gains fade out

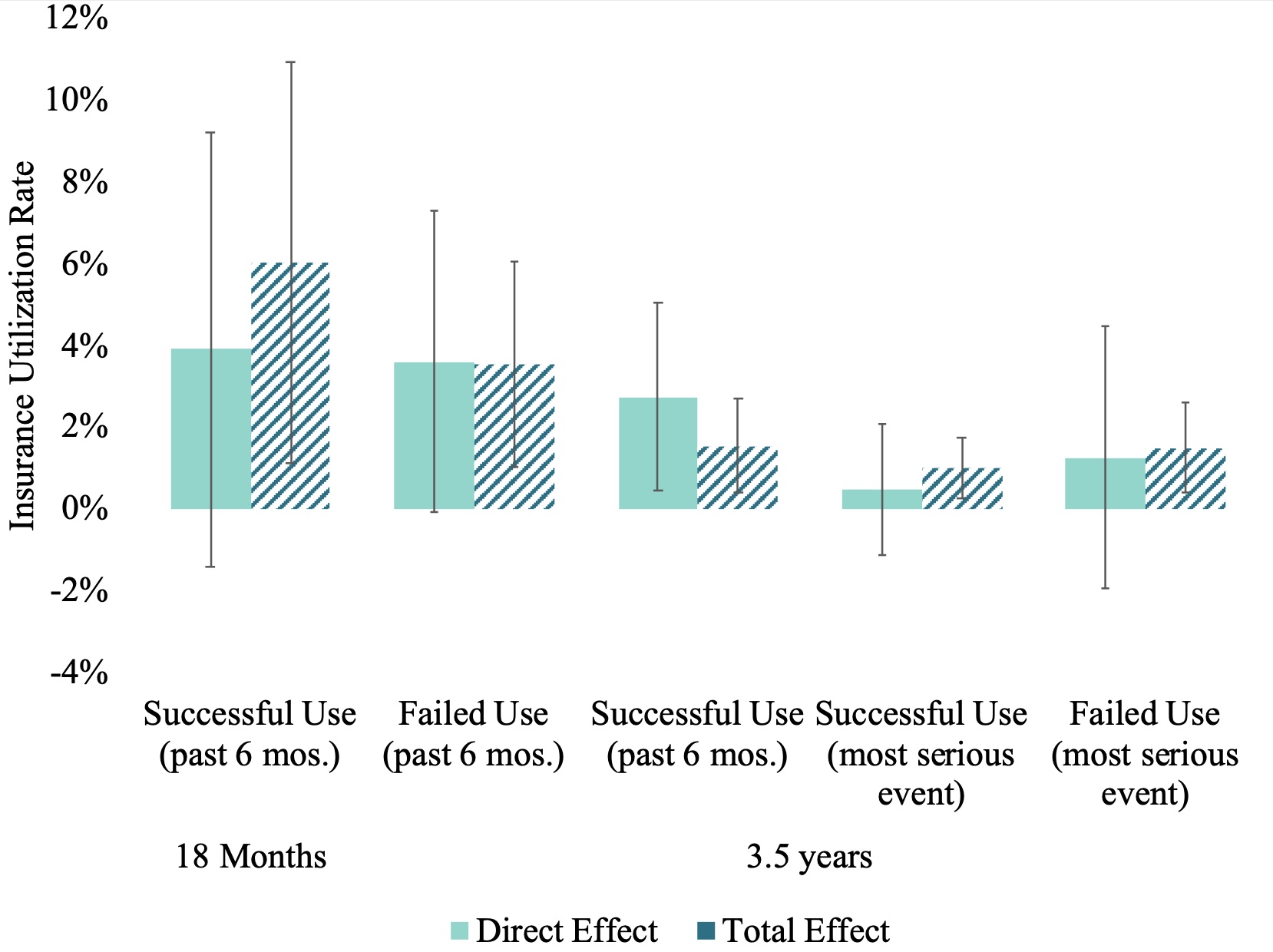

The second finding is that insurance increased utilisation, but many beneficiaries were unable to use their insurance and the utilisation effect dissipated over time. Enrollment in insurance raised utilisation by 6.02%; however, many enrolled households were unable to use insurance to cover the costs of health care. This may reflect not just supply-side constraints, but also demand-side obstacles such as households forgetting their card or trying to use RSBY at non-participating hospitals.

In addition, utilisation fell over time: six-month utilisation was just 1.60% in the free-insurance group after 3.5 years. Instead of positive learning-by-doing effects, perhaps households were discouraged by the difficulty of using the new insurance product.

The third finding is that spillovers play an important role in promoting insurance utilisation. Without those spillover effects, overall effects of the intervention on utilisation would not be statistically significant (see Figure 2). This is consistent with other findings in the literature on insurance utilisation (Chatterjee et al. 2018, Debnath and Jain 2020) and suggests that peer effects are important in learning how to utilise insurance.

Figure 2 Effects of insurance enrollment on use of insurance

Insurance did not have an impact on health outcomes

A wide array of health outcomes were measured covering outcomes reported in many prior studies (Baicker et al. 2013, Haushofer et al. 2020), including mental health and mortality, and several biomarker outcomes. We find that, after adjusting for multiple testing, health insurance failed to show statistically significant treatment effects on health-related outcomes across the two waves of surveys. There are several possible explanations for this finding.

- One is that too few households successfully used insurance for it to move the needle on health outcomes, underscoring that ‘access’ is not enough in the face of obstacles to successful use.

- Low quality of health care (Das et al. 2012) is also a possible explanation.

- Another possibility is that, given the size of the standard errors, even this study – which is amongst the largest health insurance experiments ever conducted – may lack adequate power to estimate the health effects of insurance (Goldin et al. 2019, Kaestner 2021).

Overall, these findings have implications for the implementation of public insurance in India, and perhaps other low- and middle-income countries. First, requiring higher-income households to pay for public insurance may reduce the fiscal cost of public health insurance, without seriously compromising uptake. Second, demand-side and supply-side barriers to utilisation may significantly curtail the efficacy of an ambitious health insurance programme. Third, spillover effects on insurance utilisation point to the importance of understanding the role of peers in the marketing of health insurance and other such financial products.

Editors' note: This column is published in collaboration with Ideas for India.

References

Baicker, K, et al. (2013), “The Oregon experiment — effects of Medicaid on clinical outcomes”, New England Journal of Medicine 368(18): 1713-1722.

Berg, E, M Ghatak, R Manjula, D Rajasekhar, and S Roy (2019), “Motivating knowledge agents: Can incentive pay overcome social distance?”, The Economic Journal 129(617): 110-142.

Berman, P and R Ahuja (2008), “Government health spending in India”, Economic and Political Weekly 46: 26-27.

Black, B, J-A Espín-Sánchez, E French, and K Litvak (2017), “The long-term effect of health insurance on near-elderly health and mortality”, American Journal of Health Economics 3(3): 281-311.

Chatterjee, C, R Joshi, N Sood, and P Boregowda (2018), “Government health insurance and spatial peer effects: New evidence from India”, Social Science and Medicine 196: 131-141.

Das, J, et al. (2012), “In urban and rural India, a standardised patient study showed low levels of provider training and huge quality gaps”, Health Affairs 31(12): 2774-2784.

Debnath, S and T Jain (2020), “Social connections and tertiary health-care utilisation”, Health Economics 29(4): 464-474.

Garg, S, K Bebarta, and N Tripathi (2020), “Performance of India’s national publicly-funded health insurance scheme, Pradhan Mantri Jan Arogya Yojana (PMJAY), in improving access and financial protection for hospital care: Findings from household surveys in Chhattisgarh state”, BMC Public Health 20(1): 949.

Goldin, J, I Lurie, and J McCubbin (2019), Health Insurance and Mortality: Experimental Evidence from Taxpayer Outreach (0898-2937).

Haushofer, J, M Chemin, C Jang, and J Abraham (2020), “Economic and psychological effects of health insurance and cash transfers: Evidence from a randomised experiment in Kenya”, Journal of Development Economics 144: 102416.

Kaestner, R. (2021), “Mortality and science: A comment on two articles on the effects of health insurance on mortality”, Econ Journal Watch 18(2): 192.

Malani, A, P Holtzman, K Imai, C Kinnan, M Miller, S Swaminathan, A Voena, B Woda and G Conti (2021), "Effect of health insurance in India: A randomised controlled trial", NBER Working Paper No. w29576.

Oxfam (2008), Health insurance in low-income countries: Where is the evidence that it works?

Rathi, P, A Mukherji, and G Sen (2012), “Rashtriya Swasthya Bima Yojana: Evaluating utilisation, roll-out and perceptions in Amaravati district, Maharashtra”, Economic and Political Weekly 47(39): 57-64.

World Health Organisation (2021), Global Health Expenditure Database.