Increased access to financial services after the expansion of banks in India improved household health outcomes

RCTs often find no effects

Many households in developing countries suffer from poor health. There are strong motivations to believe that finance could play a key role in improving health outcomes - in a world where resources are scarce, it should matter how they are distributed. Whether finance can move the needle on health has been primarily explored through randomised controlled trials that provide financial services to households. Surprisingly, these studies consistently find null results for savings accounts, credit, and health insurance (Karlan and Zinman 2010, Dupas and Robinson 2013, Banerjee et al. 2015, Conti et al. 2022). Complementing this evidence, my research examines the impact of finance on health in a large natural experiment that uses variation in bank presence. This allows me to explore the effect of finance on health on a large scale, over a long-time frame, and in general equilibrium. In contrast to many previous studies, I document substantial effects of finance on health.

This study uses a natural experiment

This study focuses on a policy implemented by the Reserve Bank of India (RBI) in 2005, which incentivises banks to open branches in underbanked districts. The RBI defines a district as underbanked if it has a population-to-branch ratio that exceeds the national average, classifying 375 of India’s 593 districts as underbanked. This “cut-off” in eligibility for the policy enables the use of a regression discontinuity design – within a state, I compare districts with a ratio just above the national average (treated) to those just below (control). As it is close to random whether a district is located just above or below this cut-off, the control districts in this study can be seen as a valid counterfactual, which allows me to identify the causal effect of bank presence on health. Importantly, I demonstrate that the districts are comparable before the policy.

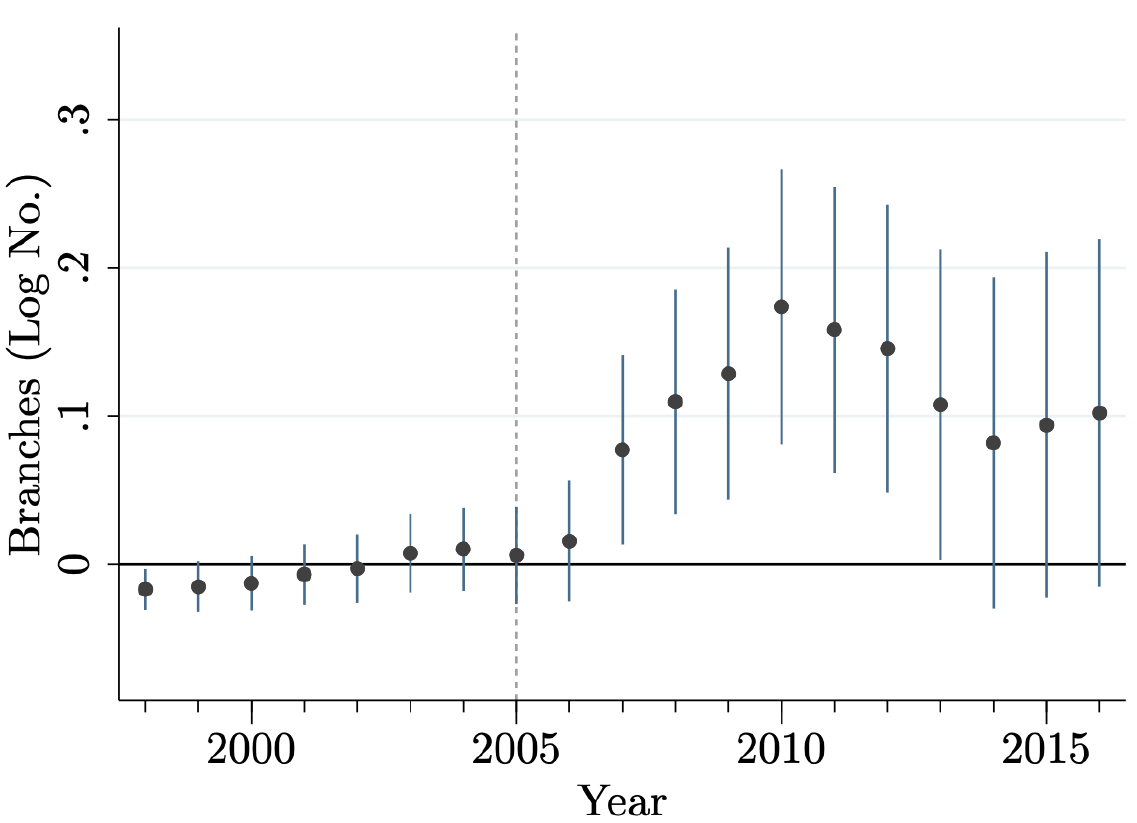

Banks set up branches in underserved areas

The policy was successful at establishing branches in underbanked districts. Figure 1 shows that the banks started setting up branches after the policy introduction in 2005. Five years after the policy, treatment districts have, on average, 19% more branches than control districts. Within these treatment districts, many postcodes – approximately equivalent to a small cities or clusters of ten villages – receive their first branch or their first private branch. In other words, many businesses, households, and healthcare providers gain access to formal financial services either for the first time or can expect increased service competition in their area.

Figure 1: Banks in underbanked districts

Households’ health substantially improves

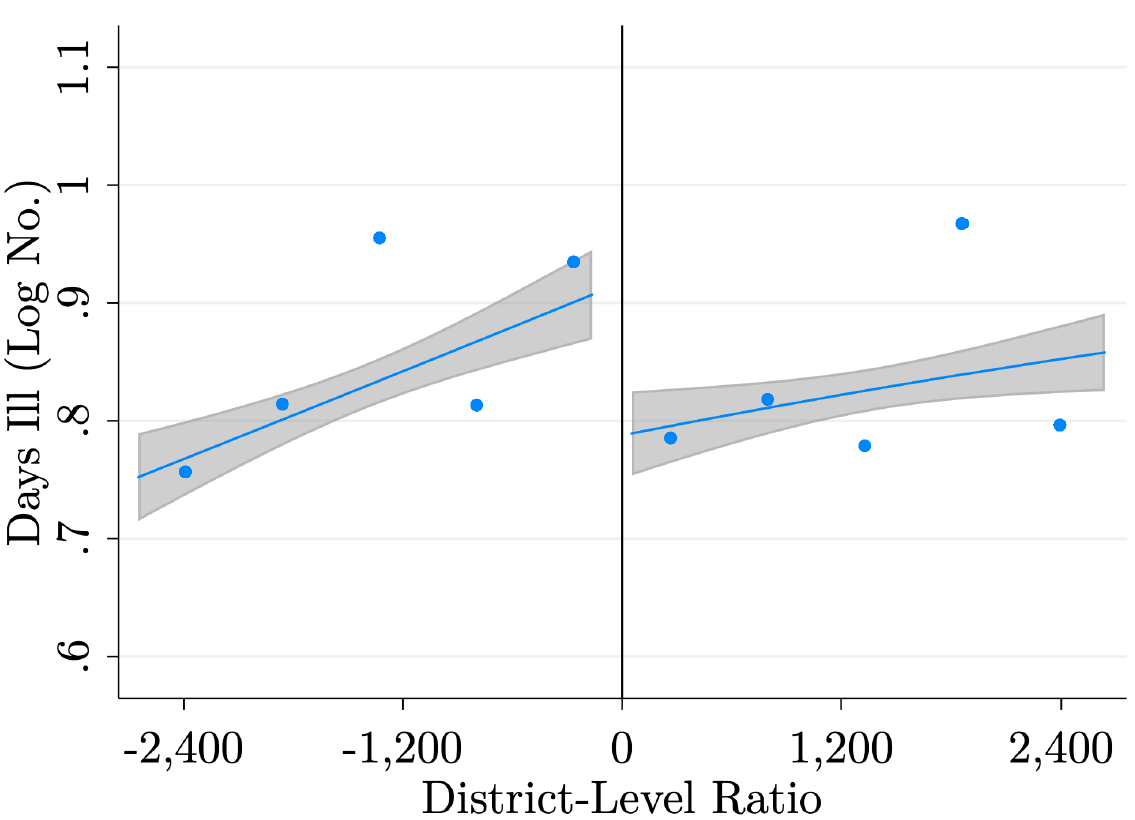

Is this increase in financial access sufficient to move the needle on health? The evidence strongly indicates that it does. Five years after the policy, surveys show that households in treatment districts are a third less likely to suffer from non-chronic diseases such as diarrhoea, fever, and cough (Figure 2). No effect is detected on chronic illnesses such as diabetes. Households are less likely to miss work or school due to an illness and pay substantially less for medical expenses as their health status improves. These effects are quantitatively substantial and comparable to other effective healthcare interventions such as conditional cash transfers or health worker monitoring (Björkman and Svensson 2009, Gertler 2004). It is often difficult to find the right lever to move health; but it can have large effects once identified. Not only do we have very effective treatments for non-chronic diseases, but for infectious diseases treating one household reduces the probability that others fall ill.

Figure 2: Non-chronic disease prevalence at the household level

General equilibrium effects in a large-scale long-term setting

The substantial effects of finance on health in this natural experiment shift our prior from randomised controlled trials. Importantly, exploring finance using a natural experiment has two important added features. First, it allows for capturing general equilibrium effects. On the healthcare demand side, the evidence is consistent with businesses getting access to loans and households getting richer. Additionally, survey data shows that households gain access to savings accounts and health insurance products; surprisingly, the latter is often offered directly at bank branches in over 50% of developing countries. On the supply side, the economic census indicates that hospitals gain access to loans and extend health care services. Second, the study explores effects of a large scale over a long timeframe.

This research highlights that finance can significantly affect health when evaluated in a large-scale, long-term, general equilibrium. This finding encourages us to think beyond partial equilibrium effects and explore interactions in markets. This not only includes healthcare markets but also, for instance, education. Like healthcare markets, finance could positively influence education if households increase demand as they become more likely to afford school fees, while schools increase supply as they gain access to credit.

References

Björkman, M and J Svensson (2009), “Power to the people: evidence from a randomized field experiment on community-based monitoring in Uganda,” The Quarterly Journal of Economics, 124(2): 735–769.

Karlan, D and J Zinman (2010), “Expanding credit access: Using randomized supply decisions to estimate the impacts,” The Review of Financial Studies, 23(1): 433–464.

Dupas, P and J Robinson (2013), “Savings constraints and microenterprise development: Evidence from a field experiment in Kenya,” American Economic Journal: Applied Economics, 5(1): 163–92.

Banerjee, A, D Karlan, and J Zinman (2015), “Six randomized evaluations of micro- credit: Introduction and further steps,” American Economic Journal: Applied Economics, 7(1): 1–21.

Consti, G, C Kinnan, A Malani, and A Voena (2022), “Direct and spillover effects of access to health insurance in India”, VoxDev Column.

Gertler, P (2004), “Do conditional cash transfers improve child health? Evidence from PROGRESA’s control randomized experiment,” American Economic Review, 94(2): 336–341.